At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

Sell Crypto Without Paying Taxes: Legal Ways

Table of Contents

Crypto’s a wild ride—prices surge, portfolios swell, and suddenly you’re eyeing a cash-out. But then the tax man looms, ready to carve up your gains like a Sunday roast. In the US, selling crypto triggers capital gains taxes, and the IRS isn’t messing around—they’ve got their sights on every Bitcoin, Ethereum, or meme coin you flip for USD $. I’ve spent years navigating blockchain’s twists and the IRS’s rulebook, and here’s the deal: you can’t dodge taxes entirely, but there are legal ways to shrink that bill to nothing—or close to it. This guide breaks down the strategies to sell crypto tax-free, or at least tax-smart, so you keep more of your hard-earned stack.

Why Crypto Taxes Sting

Before we dive into the playbook, let’s get why taxes on crypto hurt. Every time you sell, trade, or spend crypto, the IRS sees it as a taxable event. Bought Bitcoin at $10,000 and sold at $60,000? That $50,000 gain gets taxed—either as short-term capital gains (like regular income, up to 37%) if you held less than a year, or long-term (0-20%) if you held longer. Same goes for swapping ETH for USDT or buying a coffee with DOGE. The IRS’s 2020 crackdown added crypto questions to Form 1040, and exchanges like Coinbase now report your moves via Form 1099. Mess up your records? Expect audits, penalties, or worse.

But here’s the flip side: the tax code has gaps—legal ones. Smart moves can slash your liability, sometimes to zero, without dodging the law. Let’s cut through the fog and lay out the strategies that work.

Strategy 1: Hold for Long-Term Gains

The simplest way to cut taxes is to hold your crypto for over a year before selling. Short-term gains get taxed at your income rate—say, 24% for a $100,000 earner. Long-term gains? They drop to 0% if your taxable income (including the gain) stays under $47,025 for singles or $94,050 for married couples filing jointly in 2025. That’s right—zero taxes on your crypto profits if you play it cool and your income fits the bracket.

Here’s how it works. Say you bought 1 ETH at $1,000 and it’s now worth $4,000. Hold it for 366 days, sell, and pocket a $3,000 gain. If your total income (job, investments, everything) is under the threshold, you pay nothing to the IRS. Over the limit? You’ll still pay less—15% or 20% max—than short-term rates. Patience is your edge here.

Strategy 2: Offset Gains with Losses (Tax-Loss Harvesting)

Markets crash, bags bleed—it’s crypto’s nature. But losses aren’t just pain; they’re power. Tax-loss harvesting lets you sell losing assets to offset gains, wiping out your tax bill. Sold BTC for a $10,000 profit? Sell that underwater SHIB for a $10,000 loss, and your taxable gain drops to zero. You can even deduct up to $3,000 in net losses against other income (like your salary) each year, carrying forward extras to future years.

Here’s the play: check your portfolio for duds—tokens you’re ready to ditch. Sell them before year-end to lock in losses, then use them to cancel out gains from your winners. Just watch the wash-sale rule—it doesn’t apply to crypto yet, so you can rebuy the same coin right after selling, but the IRS might squint if you’re gaming it too hard. Keep records clean; software like CoinTracker can help.

Strategy 3: Donate Crypto to Charity

Want to sell crypto without taxes and look like a saint? Donate it. Gifting appreciated crypto (held over a year) to a registered 501(c)(3) charity lets you avoid capital gains tax and claim a deduction for the full market value. Say you bought 1 BTC at $5,000, now worth $50,000. Donate it to a charity like The Giving Block, and you skip taxes on the $45,000 gain while deducting $50,000 from your taxable income (if you itemize). The charity cashes out tax-free—they’re exempt.

This works best if you’ve got big gains and itemize deductions. Smaller players might not see the same kick, since the standard deduction ($14,600 single, $29,200 joint in 2025) often beats itemizing. Check with a tax pro to confirm the charity’s legit and your paperwork’s tight.

Strategy 4: Move to a Tax-Free Zone (Legally)

Here’s a bolder move: relocate to a place where capital gains don’t exist—at least for a while. Puerto Rico’s Act 60 offers US citizens a 0% tax rate on capital gains for new residents, provided they meet strict rules (like living there 183+ days a year and earning income locally). Sell your crypto after qualifying, and you could owe $0 to the IRS on those gains. But it’s not a holiday—you’ll need to commit, and the IRS watches closely for fakers.

Stateside, places like Wyoming, Nevada, and Texas have no state income tax, which helps if you’re dodging short-term gains taxed as income. Federal taxes still apply, but trimming state taxes can save thousands. Moving’s a big step, so weigh the costs—new home, new life—against the tax win.

Strategy 5: Use Crypto in Tax-Advantaged Accounts

Ever thought about crypto in a retirement account? Self-directed IRAs let you buy and sell crypto like Bitcoin or Ethereum tax-free until you withdraw. Gains grow untaxed in a Roth IRA, and if you’re over 59½ when you pull out, qualified withdrawals are tax-free too. Traditional IRAs defer taxes until withdrawal, which can still save you now if you’re in a high bracket.

Setup’s tricky—you’ll need a custodian like BitIRA or Alto, and fees can bite. Plus, you can’t touch the funds until retirement without penalties. Still, for long-term hodlers, it’s a way to trade crypto without the IRS sniffing every deal. Just don’t expect to day-trade your IRA; custodians move slow.

Strategy 6: Gift Crypto to Family

Gifting’s another sly move. You can transfer crypto to a spouse, kid, or anyone without triggering taxes, as long as it’s under $18,000 per person per year (2025 gift tax exclusion). The catch? You don’t get a deduction, and the recipient inherits your cost basis. If they sell later, they’ll owe taxes on the gain from your original purchase price. But if they’re in a lower tax bracket—like a student kid with little income—they might sell under the 0% long-term gains threshold.

Say you gift 0.5 ETH worth $2,000 (bought at $500) to your nephew. He sells when it hits $5,000. His gain’s $4,500, but if his income’s low, he pays $0 tax. You’ve moved wealth tax-free, and he cashes out clean. Just track the gift with Form 709 if it’s over the limit.

Strategy 7: Spend Crypto Strategically

Spending crypto—like buying a laptop with Bitcoin—counts as selling, so it triggers taxes. But what if you spend small amounts to stay under radar? Cards like BitPay let you load crypto and spend USD $ at retailers, converting just enough to cover the purchase. If you’re spending crypto with a low basis (say, early BTC), pair it with loss harvesting to offset gains. It’s not tax-free forever, but it spreads the hit.

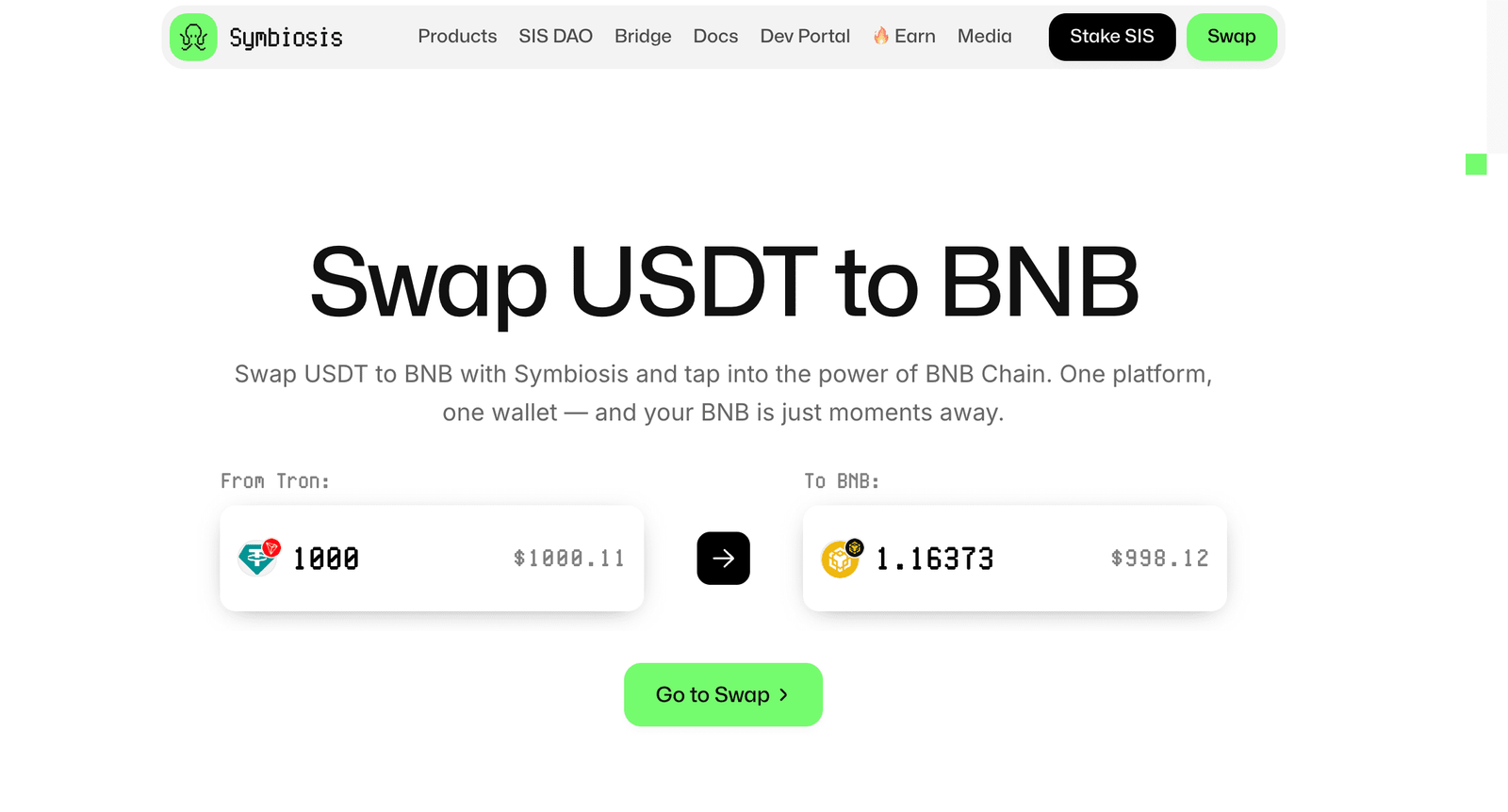

Bigger picture: firms like Coinbase now offer debit cards linked to crypto wallets. Spend stablecoins like USDC, which don’t fluctuate much, to minimize gains and simplify tracking. Always log every transaction—IRS loves receipts.

Key Caveats to Stay Legal

These strategies aren’t loopholes—they’re built into the tax code. But the IRS is no fool. Crypto exchanges share data, and blockchain’s transparent—every wallet move’s traceable. Here’s how to stay clean:

- Track Everything: Use tools like Koinly or TaxBit to log trades, sales, and cost basis. Miss a transaction, and you’re begging for an audit.

- File Form 8949: Report all crypto sales on your taxes, even if you owe $0. The IRS cross-checks 1099s from exchanges.

- Get a Pro: Tax laws shift, and crypto’s complex. A CPA who knows blockchain can save you headaches.

- Avoid Shady Moves: Hiding income or faking losses will land you in hot water. Penalties start at 20% of unpaid taxes, plus interest.

For more on IRS rules, check the IRS’s crypto FAQ or Treasury’s tax updates.

FAQs

Can I really sell crypto without paying any taxes?

Not always, but you can hit $0 tax with strategies like holding for long-term gains under the income threshold, harvesting losses, or donating to charity. Each has trade-offs, so plan carefully.

Does the IRS track every crypto sale?

They don’t see every transaction live, but exchanges like Coinbase report big trades, and blockchain’s public. If you’re audited, they’ll dig deep, so keep records.

Is tax-loss harvesting risky?

It’s legal and common, but overdoing it without clear records can raise flags. Sell only what makes sense for your portfolio, and don’t rebuy just to game losses.

Can I move to Puerto Rico to avoid taxes?

Yes, under Act 60, but it’s a serious commitment—half the year there, local income, and IRS scrutiny. It’s not a quick fix; weigh the life change first.

What’s the easiest way to cut crypto taxes?

Hold over a year and sell when your income’s low enough for 0% long-term gains. It’s straightforward, no fancy footwork needed.

Conclusion

Crypto’s your shot at freedom, but taxes can chain you down. The IRS wants its cut, yet the tax code hands you tools to fight back—legally. From holding for long-term gains to harvesting losses, donating, or even spending smart, you’ve got moves to keep more USD $ in your pocket. This isn’t about dodging the system; it’s about playing it better. Track every trade, stay honest, and lean on a pro if the numbers get messy. The market’s wild enough—don’t let taxes steal your edge. Get out there, execute, and own your financial future.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino