At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

When to Buy and Sell Crypto: Smart Timing

Table of Contents

The crypto market doesn’t sleep. It’s a relentless beast, swinging from euphoric highs to gut-punching lows, leaving most investors wondering: when’s the right time to jump in or cash out? Timing isn’t about luck—it’s about strategy. I’ve spent years dissecting blockchain data, tracking market cycles, and navigating the chaos of crypto trading. This guide isn’t fluff or hype. It’s a battle-tested roadmap to help you make smarter moves in a market that rewards the sharp and punishes the reckless.

Whether you’re a newbie with $100 to invest or a seasoned trader juggling six-figure portfolios, the principles of timing are universal. Let’s cut through the noise and lay out how to buy low, sell high, and avoid getting wrecked by volatility. This is your playbook for turning market swings into profits.

Understanding Crypto Market Cycles

Crypto markets move in cycles, driven by a mix of investor psychology, macroeconomic trends, and technological shifts. These cycles typically break into four phases: accumulation, markup, distribution, and markdown. Knowing where the market stands can mean the difference between buying at the bottom or selling into a rug pull.

- Accumulation: Prices are low, sentiment is grim, and most investors are sitting on the sidelines. This is when smart money—think whales and institutions—quietly scoops up assets. Example: Bitcoin’s price languished around $3,000-$4,000 in late 2018 before its 2019 rally.

- Markup: Prices climb as FOMO (fear of missing out) kicks in. Retail investors flood the market, pushing prices higher. This is the bull run, like Bitcoin’s surge to $69,000 in November 2021.

- Distribution: Prices plateau, and savvy players start cashing out. Volatility spikes, and weak hands panic-sell. This phase often precedes a correction.

- Markdown: The bear market. Prices crash, fear dominates, and many give up. Bitcoin’s drop to $16,000 in late 2022 is a textbook example.

Data from CoinMarketCap shows Bitcoin’s historical cycles often last 3-4 years, with halving events—when Bitcoin’s mining rewards are cut in half—acting as catalysts. The 2020 halving sparked a bull run peaking in 2021. The next halving, expected in 2028, could follow a similar pattern. But cycles aren’t set in stone. Global events, like the U.S. Federal Reserve raising interest rates or China cracking down on crypto, can accelerate or disrupt them.

When to Buy Crypto

Buying crypto is about finding value in the chaos. The goal? Get in when prices are undervalued but poised for growth. Here’s how to spot those moments.

1. Look for Bear Market Bottoms

Bear markets are brutal, but they’re also where fortunes are made. When prices tank and sentiment is at its lowest, that’s often the best time to buy. Historical data backs this up: Bitcoin’s price dipped to $3,150 in December 2018, only to climb to $13,800 by June 2019—a 340% gain. Tools like the Fear and Greed Index, which measures market sentiment, can help. A score below 20 often signals extreme fear—prime buying territory.

2. Track Macro Trends

Crypto doesn’t exist in a vacuum. U.S. monetary policy, inflation rates, and global crises impact prices. For instance, when the Federal Reserve cut interest rates in 2020 to counter COVID-19’s economic fallout, risk assets like Bitcoin soared. Conversely, rate hikes in 2022 triggered a crypto winter. Keep an eye on Federal Reserve announcements for clues on market direction.

3. Buy During Dips in a Bull Market

Even in bull runs, prices don’t go straight up. Corrections of 10-30% are common. Ethereum dropped from $4,800 to $3,500 in November 2021 before rallying again. These dips are buying opportunities if the broader trend is upward. Use dollar-cost averaging (DCA)—investing a fixed amount regularly—to reduce risk. For example, putting $100 into Bitcoin weekly smooths out volatility.

4. Watch for Adoption Signals

Crypto prices often spike when adoption grows. When PayPal announced crypto payments in 2020, Bitcoin jumped 15% in days. Monitor news for institutional moves, like banks offering custody services or governments clarifying regulations. The U.S. Securities and Exchange Commission’s approval of Bitcoin ETFs in 2024 drove prices from $45,000 to $70,000 in months.

When to Sell Crypto

Selling is harder than buying. Greed tempts you to hold forever, but locking in profits takes discipline. Here’s how to know when to cash out.

1. Set Profit Targets

Before buying, decide your exit price. A common strategy is to sell in stages. If you buy Ethereum at $2,000, you might sell 25% at $3,000, 25% at $4,000, and so on. This locks in gains while leaving room for upside. In 2021, traders who sold Bitcoin at $60,000 avoided the crash to $30,000 months later.

2. Spot Distribution Phases

When prices stall after a rally, and trading volume drops, it’s often a sign of distribution. Whales are quietly selling. On-chain data, like exchange inflows spiking, can confirm this. Glassnode reported Bitcoin exchange deposits hit a yearly high in May 2021, just before a 50% crash.

3. React to Negative News

Regulatory crackdowns or hacks can tank prices fast. China’s 2021 mining ban sent Bitcoin from $50,000 to $30,000 in weeks. If you see headlines about bans or major exchange hacks, consider selling a portion to protect gains.

4. Rebalance Your Portfolio

If one asset dominates your portfolio—say, Bitcoin grows to 80% of your holdings—it’s wise to sell some and diversify. This reduces risk. After Solana’s 2021 rally from $20 to $260, many traders sold portions to buy stablecoins or other altcoins, cushioning later volatility.

Technical Tools for Timing

Charts and indicators can sharpen your timing. You don’t need to be a math genius—just know a few basics.

- Moving Averages: The 50-day and 200-day moving averages show trends. A “golden cross” (50-day crossing above 200-day) signals a buy; a “death cross” (50-day below 200-day) signals a sell. Bitcoin’s golden cross in October 2020 preceded a 300% rally.

- Relative Strength Index (RSI): RSI measures momentum. Above 70? The asset’s overbought—consider selling. Below 30? Oversold—think about buying. Ethereum’s RSI hit 90 in November 2021, signaling a peak.

- Support and Resistance: Support is a price where buying tends to kick in (e.g., Bitcoin’s $30,000 floor in 2021). Resistance is where selling pressure grows (e.g., $60,000 in 2021). Breakouts above resistance or breakdowns below support can guide trades.

Platforms like TradingView or Coinigy offer free charting tools. Combine these with on-chain metrics, like active addresses or transaction volume, for a fuller picture.

Common Mistakes to Avoid

Even sharp traders get burned. Here’s what to dodge.

- FOMO Buying: Chasing a coin up 50% in a day often ends in a crash. If you missed the pump, wait for a dip.

- Panic Selling: Selling at a loss during a dip locks in failure. Zoom out—most assets recover over time.

- Ignoring Fees: Gas fees on Ethereum or exchange fees can eat profits. Use layer-2 solutions like Arbitrum to cut costs.

- Overleveraging: Borrowing to trade amplifies gains but also losses. In 2022, overleveraged traders lost billions in liquidations.

Taxes and Legal Considerations

In the U.S., crypto is taxed as property. Selling at a profit triggers capital gains tax—15-20% for assets held over a year, or up to 37% for short-term gains. Track every trade with tools like CoinTracker to avoid IRS headaches. The IRS website has clear guidelines. Also, ensure your exchange complies with KYC (Know Your Customer) rules to avoid legal trouble.

FAQs

Is it too late to invest in crypto?

No. Crypto’s still young. Bitcoin’s market cap is $1.2 trillion, but global wealth exceeds $400 trillion. Adoption is growing, and new sectors like DeFi and NFTs offer fresh opportunities. Start small and focus on long-term value.

How much should I invest?

Only what you can afford to lose. A common rule is 1-5% of your portfolio. If you’re new, start with $100-$500 and use DCA to build positions.

Can I time the market perfectly?

Nobody can. Even pros miss peaks and bottoms. Focus on consistent strategies like DCA or profit-taking to stack gains over time.

What’s the safest way to store crypto?

Use a hardware wallet like Ledger or Trezor for long-term holdings. Keep your seed phrase offline and never share it. For active trading, reputable exchanges like Coinbase or Kraken are solid, but enable 2FA.

Conclusion

Timing the crypto market isn’t about crystal balls or insider tips—it’s about discipline, data, and a willingness to act when others freeze. By understanding cycles, using technical tools, and avoiding emotional traps, you can turn volatility into opportunity. The market’s wild, but it’s not random. Start small, stay sharp, and build your strategy one trade at a time. Crypto’s a marathon, not a sprint—your next move could be the one that changes everything.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

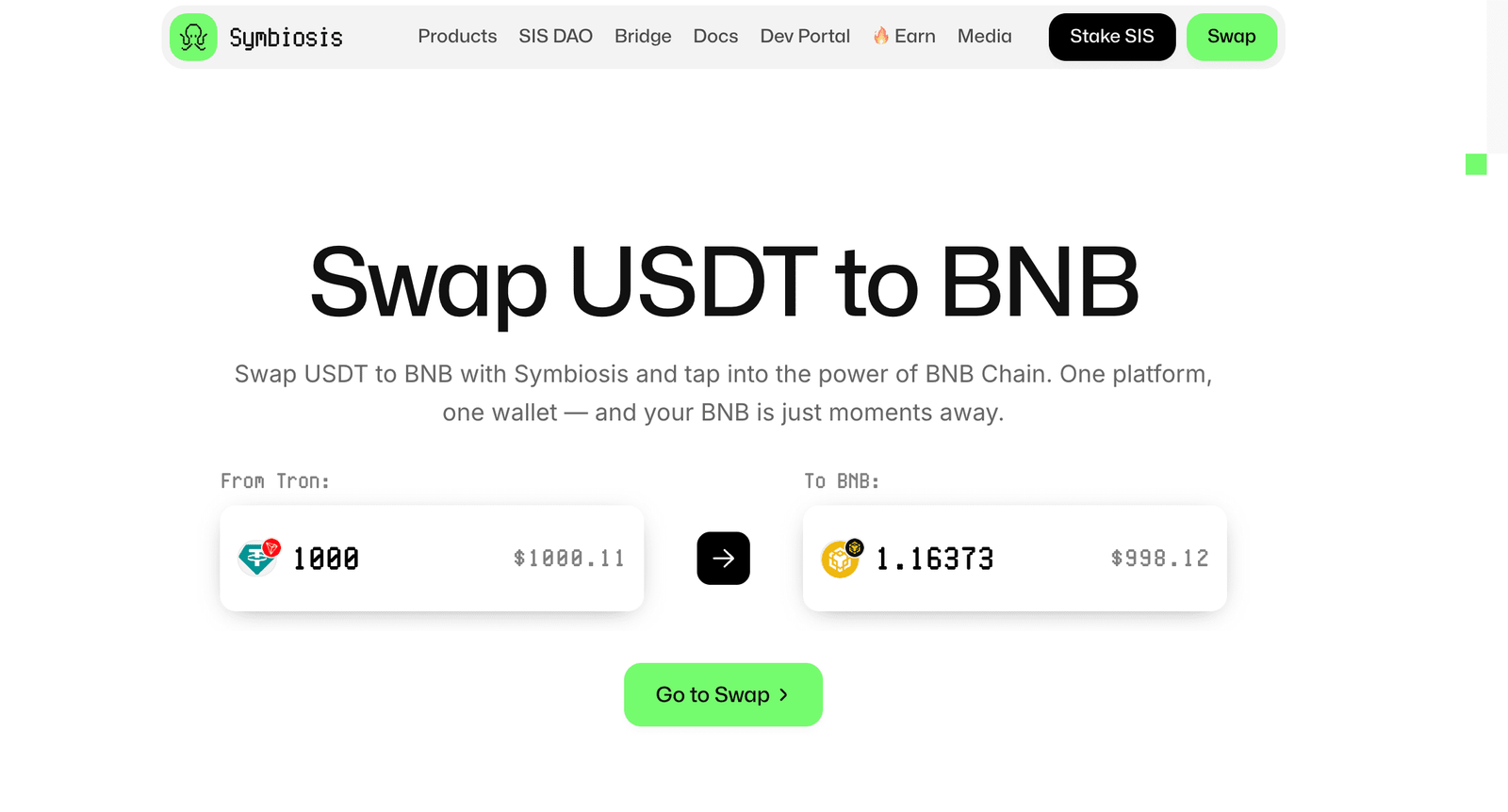

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino