At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

Sell Crypto from Cold Wallet: Full Guide

Table of Contents

Your crypto’s sitting in a cold wallet, locked away like a vault in a digital fortress. It’s safe, sure, but what happens when you want to cash out? Maybe the market’s spiking, or you’re ready to lock in profits after years of hodling. Selling from a cold wallet isn’t as simple as hitting a button on an app—it’s a deliberate process that demands precision to keep your funds secure and your gains intact. I’ve been in the crypto trenches, navigating blockchain mechanics and market chaos, and I’m here to walk you through every step. This guide breaks down how to sell your crypto from a cold wallet, from connecting to an exchange to depositing USD in your bank account, all while dodging scams and costly missteps.

Why Sell from a Cold Wallet?

Cold wallets—hardware devices like Ledger or Trezor, or even paper wallets—are the gold standard for securing crypto. They keep your private keys offline, far from hackers and phishing scams. But when it’s time to sell, you’re bridging that offline fortress to the online world, which introduces risks. Selling from a cold wallet lets you maintain control over your assets until the last moment, ensuring your crypto stays safe until it’s converted to cash. The payoff? You cash out on your terms, with maximum security and minimal exposure.

Step-by-Step Guide to Selling Crypto from a Cold Wallet

Let’s cut through the noise and get to the strategy. Here’s how to sell your crypto from a cold wallet, step by step, with the precision you need to dominate the process.

Step 1: Choose a Reputable Exchange

Your cold wallet doesn’t connect directly to your bank account, so you’ll need a trusted cryptocurrency exchange to convert your crypto to USD. Popular options include Coinbase, Kraken, and Binance.US, each with varying fees, withdrawal options, and security measures. For U.S. users, Coinbase and Kraken are solid choices due to their compliance with regulations and straightforward fiat withdrawal processes.

- Coinbase: User-friendly, with a 1-4% fee depending on the transaction type. Offers direct bank transfers.

- Kraken: Known for lower fees (0.9-2%) and strong security. Ideal for larger transactions.

- Binance.US: Competitive fees but fewer fiat withdrawal options for U.S. users.

Before choosing, verify the exchange’s legitimacy. Check for regulatory compliance with bodies like the U.S. Financial Crimes Enforcement Network (FinCEN). For example, Coinbase is registered with FinCEN as a Money Services Business, which adds a layer of trust. Avoid obscure platforms promising zero fees—they’re often scams waiting to rug-pull your funds.

Pro move: Set up and verify your exchange account before transferring crypto. Most platforms require identity verification (KYC), which can take days. Get this done early to avoid delays when you’re ready to cash out.

Step 2: Prepare Your Cold Wallet

Your cold wallet holds your private keys, the cryptographic codes that prove ownership of your crypto. Whether it’s a Ledger Nano X, Trezor Model T, or a paper wallet, ensure it’s accessible and functional.

- Hardware Wallet: Plug it into a secure, malware-free computer. Update the device firmware using official software (e.g., Ledger Live or Trezor Suite) to avoid vulnerabilities.

- Paper Wallet: Double-check your private key and public address. If it’s a QR code, ensure it’s legible.

Confirm your wallet’s balance. For Bitcoin, Ethereum, or other major coins, use a blockchain explorer like Blockchain.com to verify your public address holds the expected amount. Never share your private key or seed phrase—anyone with access can drain your wallet.

Step 3: Connect Your Cold Wallet to the Exchange

To sell, you’ll transfer crypto from your cold wallet to the exchange’s hot wallet (their online storage). This is where precision matters—mistakes can be costly.

- Generate a Deposit Address: Log into your exchange account and navigate to the deposit section. Select your cryptocurrency (e.g., Bitcoin, Ethereum). The exchange will provide a unique deposit address or QR code.

- Send a Test Transaction: Transfer a small amount (e.g., $10 worth) to the exchange to confirm the address is correct. Wait for the transaction to confirm on the blockchain (10-60 minutes, depending on the network).

- Transfer the Full Amount: Once the test transaction clears, send the desired amount. Use your cold wallet’s software to initiate the transfer, signing the transaction offline for security.

Double-check the deposit address before sending. Blockchain transactions are irreversible—if you send funds to the wrong address, they’re gone. For added security, use a QR code to avoid copy-paste errors. Expect to pay a network fee (e.g., $1-$10 for Bitcoin, $0.50-$5 for Ethereum), which varies based on network congestion.

Step 4: Sell Your Crypto

Once your crypto lands in the exchange’s wallet, you’re ready to sell. Most exchanges offer two options:

- Market Order: Sell instantly at the current market price. Best for quick cash-outs but may slip slightly due to price fluctuations.

- Limit Order: Set a specific price to sell. Useful for locking in gains during volatile markets but may take longer to execute.

Calculate fees before selling. For example, Coinbase charges a spread of about 0.5% plus a flat or percentage-based fee (e.g., $0.99-$2.99 for small trades). If you’re selling $10,000 in Bitcoin, expect $100-$400 in fees, depending on the platform and order type.

Pro move: Monitor market trends before selling. Tools like CoinMarketCap or TradingView can help you time your sale to avoid dumping during a dip. If you’re selling large amounts (e.g., $50,000+), consider breaking it into smaller trades to minimize price impact.

Step 5: Withdraw USD to Your Bank Account

After selling, your exchange account will hold USD. To get it to your bank, follow these steps:

- Link Your Bank Account: Add your bank details via ACH transfer (free on most platforms) or wire transfer ($10-$25 fee). Ensure the account matches your exchange’s KYC details.

- Initiate Withdrawal: Select the amount to withdraw. Most exchanges process ACH transfers in 1-5 business days; wires are faster but costlier.

- Verify the Transaction: Check your bank statement to confirm the deposit. Keep records for tax purposes.

Be aware of withdrawal limits. Coinbase, for instance, caps daily withdrawals at $50,000 for most users, while Kraken’s limits vary by verification level. If you’re cashing out significant sums, contact the exchange’s support to streamline the process.

Step 6: Secure Your Remaining Assets

If you didn’t sell your entire stack, secure the remaining crypto. Transfer it back to your cold wallet or a new wallet if you suspect the old one was compromised during the process. Update your seed phrase storage—store it in a fireproof safe or a safety deposit box, never digitally.

Pro move: Use a multi-signature wallet for large holdings. These require multiple private keys to authorize transactions, adding an extra layer of security.

Tax Implications of Selling Crypto

In the U.S., selling crypto triggers a taxable event. The Internal Revenue Service (IRS) treats crypto as property, meaning you owe capital gains tax on profits. Here’s the breakdown:

- Short-Term Capital Gains: If you held the crypto for less than a year, profits are taxed as ordinary income (10-37% based on your tax bracket).

- Long-Term Capital Gains: If held for over a year, rates are lower (0-20%).

Calculate your gain by subtracting the cost basis (what you paid for the crypto) from the sale price, minus fees. For example, if you bought 1 BTC for $20,000, sold it for $60,000, and paid $500 in fees, your taxable gain is $39,500.

Keep detailed records of every transaction, including dates, amounts, and fees. Tools like CoinTracker or Koinly can automate this. Report gains on IRS Form 8949 and Schedule D. For guidance, see the IRS’s crypto tax FAQ at IRS.gov.

Pro move: Consult a crypto-savvy accountant if your portfolio is complex or involves DeFi, staking, or airdrops, as these can complicate reporting.

Common Pitfalls and How to Avoid Them

Selling crypto from a cold wallet is straightforward if you stay sharp, but the crypto world is a minefield of scams and errors. Here are the biggest traps and how to sidestep them:

- Phishing Scams: Fake exchange websites or emails trick users into sharing private keys. Always type the exchange’s URL directly or use a bookmark. Enable two-factor authentication (2FA) with an authenticator app, not SMS.

- Wrong Addresses: Sending crypto to an incorrect address is a one-way ticket to loss. Triple-check addresses and use test transactions.

- High Fees: Network fees can spike during market pumps. Check fee estimators like BitcoinFees or Etherscan to time your transfer.

- Tax Ignorance: Failing to report crypto sales can lead to IRS audits. Track every trade and report accurately.

FAQs

Can I sell crypto directly from my cold wallet?

No, cold wallets are offline and don’t connect directly to exchanges. You must transfer crypto to an exchange’s hot wallet to sell, then withdraw USD to your bank.

How long does it take to cash out crypto from a cold wallet?

The process takes 1-7 days, depending on blockchain confirmation times (10-60 minutes), exchange processing (instant to 1 day), and bank transfer times (1-5 days).

Are there fees for selling crypto?

Yes, expect network fees ($0.50-$10), exchange trading fees (0.5-4%), and bank withdrawal fees ($0-$25). Fees vary by platform and transaction size.

Is it safe to sell crypto from a cold wallet?

Yes, if you use a reputable exchange, verify addresses, and secure your private keys. Cold wallets minimize online exposure, making them safer than hot wallets.

Do I need to pay taxes on crypto sales?

Yes, the IRS requires reporting capital gains on crypto sales. Short-term gains (held under a year) are taxed as ordinary income; long-term gains (over a year) have lower rates.

Conclusion

Selling crypto from a cold wallet is your ticket to turning digital assets into real-world cash, but it’s not a game of chance—it’s a strategy. By choosing a trusted exchange, securing your wallet, and navigating fees and taxes with precision, you can cash out with confidence. The crypto market is wild, full of pumps, dumps, and scams, but you’re not here to get played. Follow this guide, stay sharp, and take control of your financial future. Ready to make your move? Set up that exchange account, double-check your wallet, and start locking in those gains.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

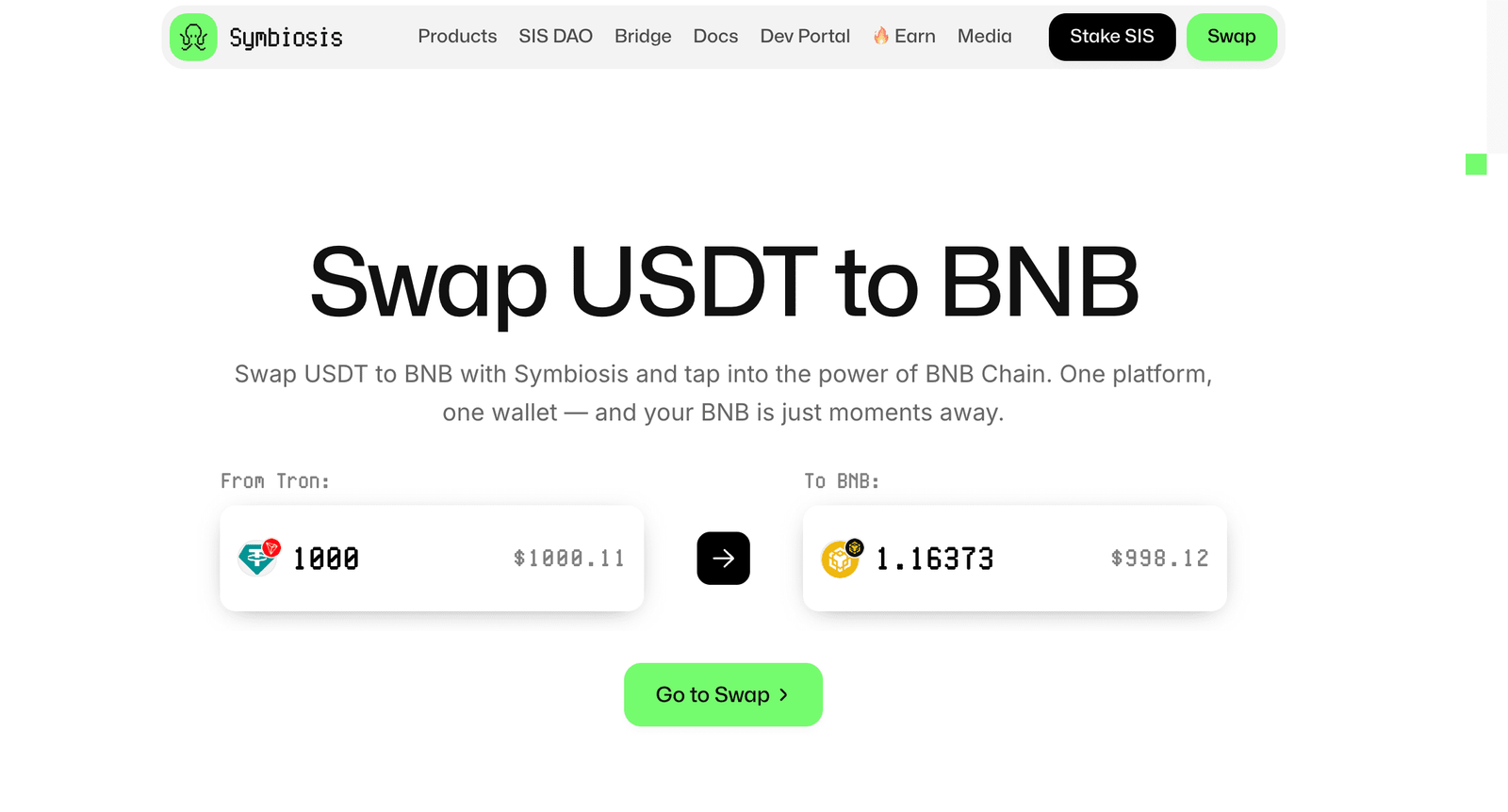

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino