At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

How Long Does Selling Crypto Take? Explained

Table of Contents

You’ve decided to cash out your crypto—maybe Bitcoin’s soaring, or you’re ready to lock in profits from an altcoin run. But how long does it actually take to turn your digital coins into USD in your bank account? The answer isn’t one-size-fits-all. Selling crypto involves multiple steps, from trading on an exchange to navigating blockchain confirmations and bank processing times. For American users, factors like platform choice, payment methods, and even tax compliance can stretch or shrink the timeline. This guide cuts through the chaos, offering a clear, no-nonsense breakdown of how long it takes to sell crypto and what you can do to speed things up. Whether you’re a newbie or a seasoned trader, here’s your roadmap to getting dollars in hand, fast and secure.

Understanding the Crypto Selling Process

Selling cryptocurrency isn’t just hitting a “sell” button and watching dollars roll in. It’s a multi-step process that varies depending on where your crypto lives (exchange, hardware wallet, or DeFi platform) and how you’re cashing out. At its core, the process includes:

- Transferring crypto to a selling platform (if it’s not already there).

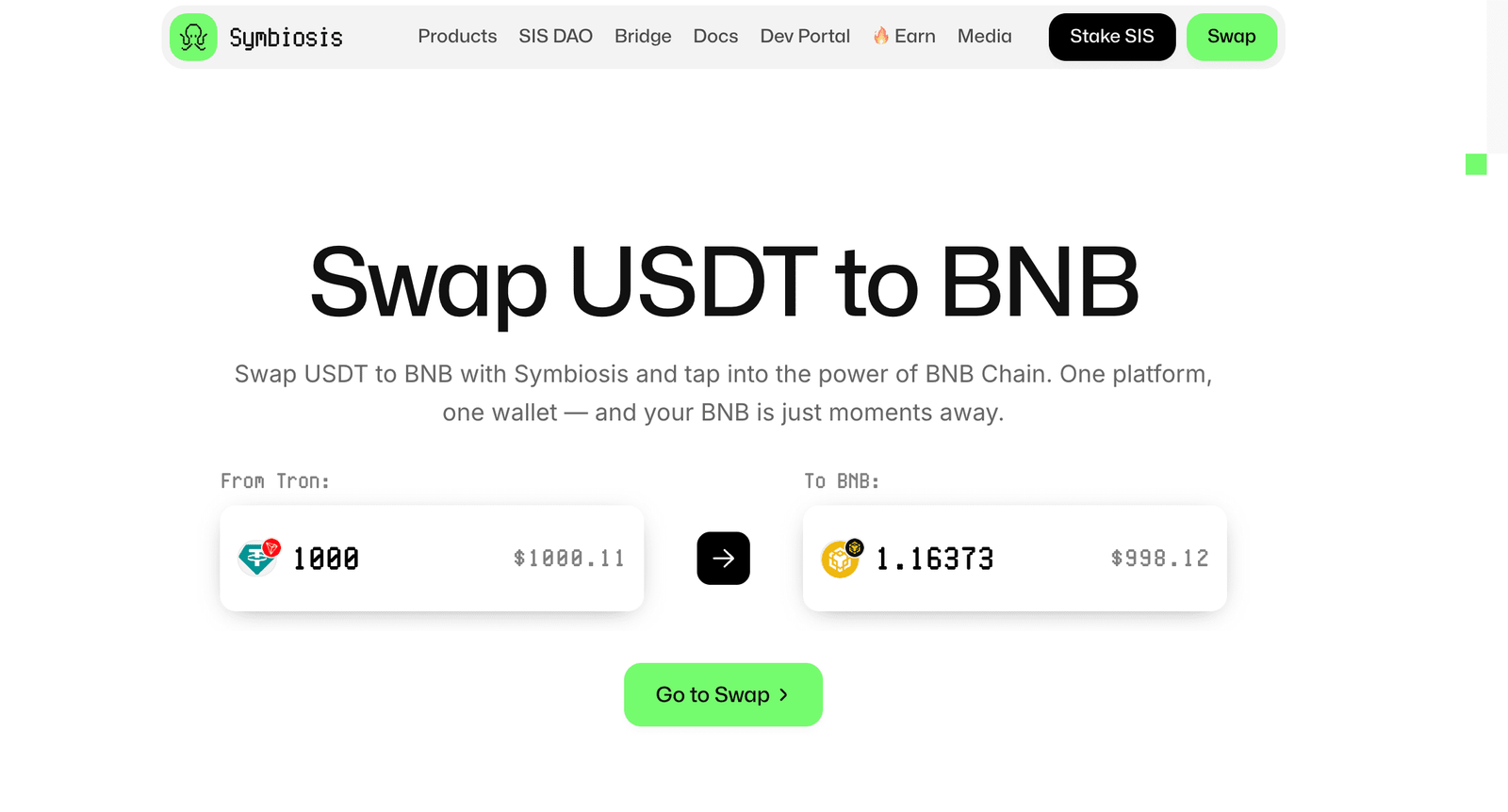

- Executing a trade to convert crypto to USD or a stablecoin like USDT.

- Withdrawing USD to your bank account or another payment method.

Each step has its own timeline, influenced by blockchain confirmations, platform processing, banking systems, and even your verification status. For U.S. users, regulatory hurdles like Know Your Customer (KYC) checks and IRS reporting add layers to navigate. Let’s break down the timeline for each phase and explore what affects the speed.

Step 1: Transferring Crypto to a Selling Platform

If your crypto is already on an exchange like Coinbase or Binance.US, you can skip this step. But if it’s in a hardware wallet (like a Ledger Nano X), a software wallet (like MetaMask), or a DeFi protocol, you’ll need to transfer it to a platform that supports fiat withdrawals. This step’s duration depends on the blockchain and network congestion.

For Bitcoin, transactions typically take 10-30 minutes to confirm, assuming you pay standard network fees. During high market volatility, when miners are flooded with transactions, this can stretch to an hour or more unless you pay a premium fee. Ethereum transfers are faster, often 1-5 minutes, but gas fees spike during network congestion (e.g., during a major NFT drop). Solana and Polygon are lightning-fast, with confirmations in seconds, but their low fees can still add up if you’re moving small amounts.

Once the transfer hits the exchange’s wallet, some platforms require additional confirmations for security. Coinbase, for example, may wait for 3-6 Bitcoin confirmations (30-60 minutes), while Binance.US often processes deposits after 1 confirmation (10 minutes). Check the exchange’s deposit policy to avoid surprises. To speed this up, use faster blockchains like Solana or pay higher fees for priority processing on Bitcoin or Ethereum.

Step 2: Executing the Sale

Once your crypto is on the exchange, selling it for USD or a stablecoin is the next step. This phase is usually the fastest, but the method you choose—market order, limit order, or a “convert” feature—impacts the timeline.

Market Orders

Market orders are the quickest way to sell. You’re agreeing to sell your crypto at the current market price, and the trade executes in seconds. On major U.S. exchanges like Coinbase, Kraken, or Binance.US, market orders for liquid assets like Bitcoin or Ethereum complete almost instantly, assuming there’s enough liquidity. Even for less liquid altcoins like Cardano or Polkadot, trades rarely take more than a minute.

Limit Orders

Limit orders let you set a specific price to sell, but they only execute when the market hits your target. This could take seconds, hours, or never, depending on price movements. For example, if Bitcoin’s at $60,000 and you set a limit order to sell at $62,000, you’re waiting until the price climbs—or you cancel the order. Limit orders are strategic but can delay your sale if the market doesn’t cooperate.

Convert or Instant Sell Features

Many exchanges offer “convert” or “instant sell” options for simplicity. Coinbase’s “Sell” feature or Binance.US’s “Buy & Sell” tool lets you swap crypto for USD or stablecoins in one click. These are essentially market orders under the hood, completing in seconds, but the exchange may lock in a slightly worse rate due to spreads. For example, Coinbase’s spread can add 0.5-2% to the cost, so compare rates before confirming.

In rare cases, high market volatility or technical issues can slow trades. During a flash crash or pump, exchanges may experience lag or temporarily halt trading. This is uncommon on top-tier platforms but worth noting if you’re selling during a market frenzy.

Step 3: Withdrawing USD to Your Bank Account

The final step—getting USD to your bank account—is often the slowest, as it involves banking systems and regulatory checks. U.S. exchanges offer several withdrawal methods, each with its own timeline:

ACH Transfers

ACH (Automated Clearing House) transfers are the most common way to withdraw USD. They’re free or low-cost ($0.15-$10 on most platforms) but take 1-5 business days to hit your account. Coinbase typically processes ACH withdrawals in 1-3 business days, while Binance.US may take up to 5. Weekends and holidays don’t count as business days, so a withdrawal initiated on Friday could take until the following week.

Wire Transfers

Wire transfers are faster, often same-day or next-day, but cost more ($10-$25 on average). Kraken and Gemini prioritize wire transfers for high-net-worth users, with funds sometimes arriving within hours. However, your bank may impose additional fees or delays, especially for international wires.

PayPal or Debit Card

Some exchanges, like Coinbase, support instant withdrawals to PayPal or linked debit cards for a fee (1-2% of the amount). These are near-instant, with funds available in minutes, but limits are lower (e.g., $25,000 per transaction on Coinbase). PayPal withdrawals are ideal for smaller amounts, while debit card withdrawals suit urgent needs.

Withdrawal speed also depends on your account status. Unverified accounts or those flagged for suspicious activity face delays or holds. For example, Binance.US may hold withdrawals for 10 days for new accounts or large transactions to comply with anti-money-laundering (AML) rules. Complete KYC early and link your bank before selling to avoid bottlenecks.

Factors That Affect Selling Time

Several variables can stretch or shrink the timeline for selling crypto. Understanding these helps you plan and avoid frustration.

Platform Choice

Not all exchanges are equal. Coinbase and Binance.US are U.S.-regulated and prioritize fast fiat withdrawals, but smaller or offshore platforms may have slower processing or limited USD options. For example, KuCoin doesn’t support direct USD withdrawals, forcing you to convert to stablecoins and move to another exchange, adding hours or days.

Blockchain Congestion

If you’re transferring crypto to an exchange, blockchain speed matters. Bitcoin’s 10-minute block time is sluggish compared to Solana’s sub-second confirmations. Network congestion—common during market spikes—can delay transfers unless you pay higher fees.

Verification Status

KYC and AML checks are mandatory for U.S. users. Incomplete verification can freeze withdrawals or trigger manual reviews, adding days. Advanced verification (including SSN) unlocks higher limits and faster processing on most platforms.

Market Volatility

Extreme price swings can slow exchanges due to high trading volume or temporary halts. In 2021, Coinbase faced outages during a Bitcoin crash, delaying trades for hours. Stick to reputable platforms with robust infrastructure to minimize this risk.

Bank Processing

Your bank’s policies matter. Some banks flag crypto-related deposits, requiring manual approval, which can add 1-2 days. Use crypto-friendly banks like Ally or Chase to streamline transfers.

Selling Crypto from Hardware Wallets

If your crypto is on a hardware wallet like a Ledger Nano X or Trezor, selling takes longer due to the transfer step. Here’s a typical timeline:

- Transfer to exchange: 5-60 minutes, depending on the blockchain.

- Sell on exchange: Seconds for market orders.

- Withdraw USD: 1-5 business days (ACH) or same-day (wire/PayPal).

Total time: 1-5 days, assuming ACH withdrawal. To speed this up, use a fast blockchain (e.g., Polygon) and opt for PayPal or wire transfers. Always double-check the exchange’s deposit address—sending to the wrong one means losing your funds.

Selling Crypto via Peer-to-Peer (P2P) Platforms

P2P platforms like LocalBitcoins or Paxful connect you directly with buyers. You sell crypto for USD via bank transfer, PayPal, or even cash. Timelines vary wildly:

- Finding a buyer: Minutes to hours, depending on demand.

- Trade execution: Seconds to minutes once agreed.

- Payment receipt: Instant (PayPal) to 1-3 days (bank transfer).

P2P can be faster than exchanges for instant payment methods but carries risks. Scams are common, and disputes can delay funds. Use escrow services and vetted buyers to minimize headaches.

Tax Implications for U.S. Users

Selling crypto in the U.S. isn’t just about speed—it’s about staying compliant. The IRS classifies crypto as property, so every sale triggers a capital gains tax event. Sell Bitcoin for $50,000 that you bought for $30,000, and you owe tax on the $20,000 gain. Short-term gains (held under a year) are taxed as ordinary income (up to 37%), while long-term gains (over a year) range from 0-20%, depending on your income.

Exchanges like Coinbase and Binance.US provide transaction histories for tax reporting. Export these to software like CoinTracker or TurboTax to calculate gains. Report sales on IRS Form 8949 and Schedule D. Failing to report can trigger audits, especially since the IRS now asks about crypto on Form 1040. For detailed guidance, see the IRS’s crypto FAQ at irs.gov.

Tips to Speed Up the Selling Process

- Complete KYC early to avoid withdrawal holds.

- Use fast blockchains like Solana or Polygon for transfers.

- Opt for market orders or instant sell features for quick trades.

- Choose PayPal or wire transfers for faster USD withdrawals.

- Stick to U.S.-regulated exchanges like Coinbase or Kraken for reliable fiat off-ramps.

- Monitor network fees and pay more for priority during congestion.

- Use crypto-friendly banks to avoid deposit flags.

Common Pitfalls and How to Avoid Them

The crypto space is a minefield. Here’s how to dodge delays and losses:

- Wrong addresses: Always double-check deposit addresses. One typo, and your crypto’s gone.

- Unverified accounts: Delays from KYC or AML checks can stall withdrawals. Verify fully before selling.

- High fees: Compare exchange fees and spreads. Coinbase’s instant sell feature is convenient but costly.

- Market timing: Don’t sell during crashes unless necessary. Set limit orders to catch pumps.

- Scams: On P2P platforms, stick to escrow and reputable buyers. Never release crypto before payment clears.

FAQs

How long does it take to sell crypto on Coinbase?

Selling on Coinbase takes seconds for market orders. ACH withdrawals to your bank take 1-3 business days, while PayPal or debit card withdrawals are instant for a fee.

Can I sell crypto instantly?

Yes, market orders or instant sell features on exchanges like Binance.US execute in seconds. However, getting USD to your bank can take 1-5 days unless you use PayPal or wires.

Why is my crypto withdrawal taking so long?

Delays can stem from blockchain congestion, exchange confirmation requirements, unverified accounts, or bank processing. Check the blockchain explorer and your account status.

Do I have to pay taxes on every crypto sale?

Yes, the IRS requires reporting all crypto sales as capital gains or losses. Use exchange transaction histories and file via Form 8949 and Schedule D.

Which is the fastest way to sell crypto?

Sell on a U.S. exchange like Coinbase with a market order and withdraw via PayPal or debit card for near-instant USD access, though fees apply.

Conclusion

Selling crypto doesn’t have to be a waiting game. From blockchain transfers to bank deposits, the process can take minutes to days, but you’ve got the power to speed it up. Stick to U.S.-regulated exchanges, complete KYC early, and choose fast withdrawal methods like PayPal or wires. Keep an eye on network fees, market volatility, and tax obligations to stay ahead. The crypto market’s a wild beast, but with this guide, you’re armed to cash out swiftly, dodge pitfalls, and claim your profits. Take control, make your move, and turn your coins into dollars on your terms.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem

Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino