At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

How to Sell Crypto on MetaMask in Minutes

Table of Contents

The crypto market moves fast—sometimes too fast. One day you’re riding a wave of gains, the next you’re wondering if it’s time to cash out before the tide turns. If you’ve got Ethereum, USDT, or any other token sitting in your MetaMask wallet, you’re not stuck holding forever. Selling crypto on MetaMask is straightforward, secure, and something anyone with a bit of grit can nail in minutes. I’ve been in the blockchain game long enough to know the traps and shortcuts, and this guide lays out a battle plan to get your funds into USD without breaking a sweat.

MetaMask isn’t just a wallet—it’s your gateway to decentralized finance. Whether you’re a newbie who stumbled into crypto via an airdrop or a seasoned trader looking to lock in profits, selling through MetaMask connects you to exchanges, bridges, and fiat off-ramps with control in your hands. No middleman, no excuses. Let’s cut through the noise and walk you through how to turn your crypto into cash, step by step, with the latest tools and tactics for American users.

Why Sell Crypto on MetaMask?

Before we dive in, let’s get real about why you might want to sell. Maybe you’ve hit a price target on ETH after a bull run, or you’re eyeing a new investment outside crypto—say, a car or a down payment. Perhaps the market’s looking shaky, and you want to park some funds in USD to dodge a dip. Whatever your reason, MetaMask gives you options. It’s not about dumping your whole stack; it’s about having the freedom to move when the time’s right.

MetaMask integrates with decentralized exchanges (DEXs) like Uniswap, bridges to centralized platforms, and even direct fiat off-ramps in some regions. For Americans, this means you can swap tokens for stablecoins like USDC, transfer to an exchange like Coinbase, or use MetaMask Portfolio’s built-in tools to cash out to your bank. The key? You stay in the driver’s seat, with your private keys secure and no third party holding your funds hostage.

What You’ll Need to Get Started

Selling crypto isn’t a “wing it” moment. You need a few things in place to make it smooth and safe. Here’s your checklist:

- MetaMask Wallet: Ensure it’s installed as a browser extension (Chrome, Firefox, or Edge) or on your mobile app (iOS or Android). Double-check you’ve got your seed phrase backed up somewhere offline—never stored digitally.

- Crypto to Sell: Whether it’s ETH, ERC-20 tokens like USDT, or something niche, confirm it’s in your MetaMask wallet on the Ethereum mainnet or a supported Layer 2 like Arbitrum.

- Gas Funds: You’ll need ETH to cover transaction fees (gas). Even a small amount, like $10-$20 worth, should suffice for most swaps or transfers.

- Exchange Account: For cashing out to USD, you’ll likely need an account on a centralized exchange like Coinbase, Kraken, or Gemini, with a linked U.S. bank account.

- KYC Compliance: Most fiat off-ramps require Know Your Customer (KYC) verification—think ID and address proof. Have this ready to avoid delays.

- Secure Connection: Use a trusted device and Wi-Fi. Public networks or sketchy hotspots are a recipe for hacks.

If any of these sound like gaps, sort them out first. Crypto doesn’t forgive sloppy prep, and you don’t want to be the guy who loses funds to a phishing scam or a rushed mistake.

Step-by-Step Guide to Selling Crypto on MetaMask

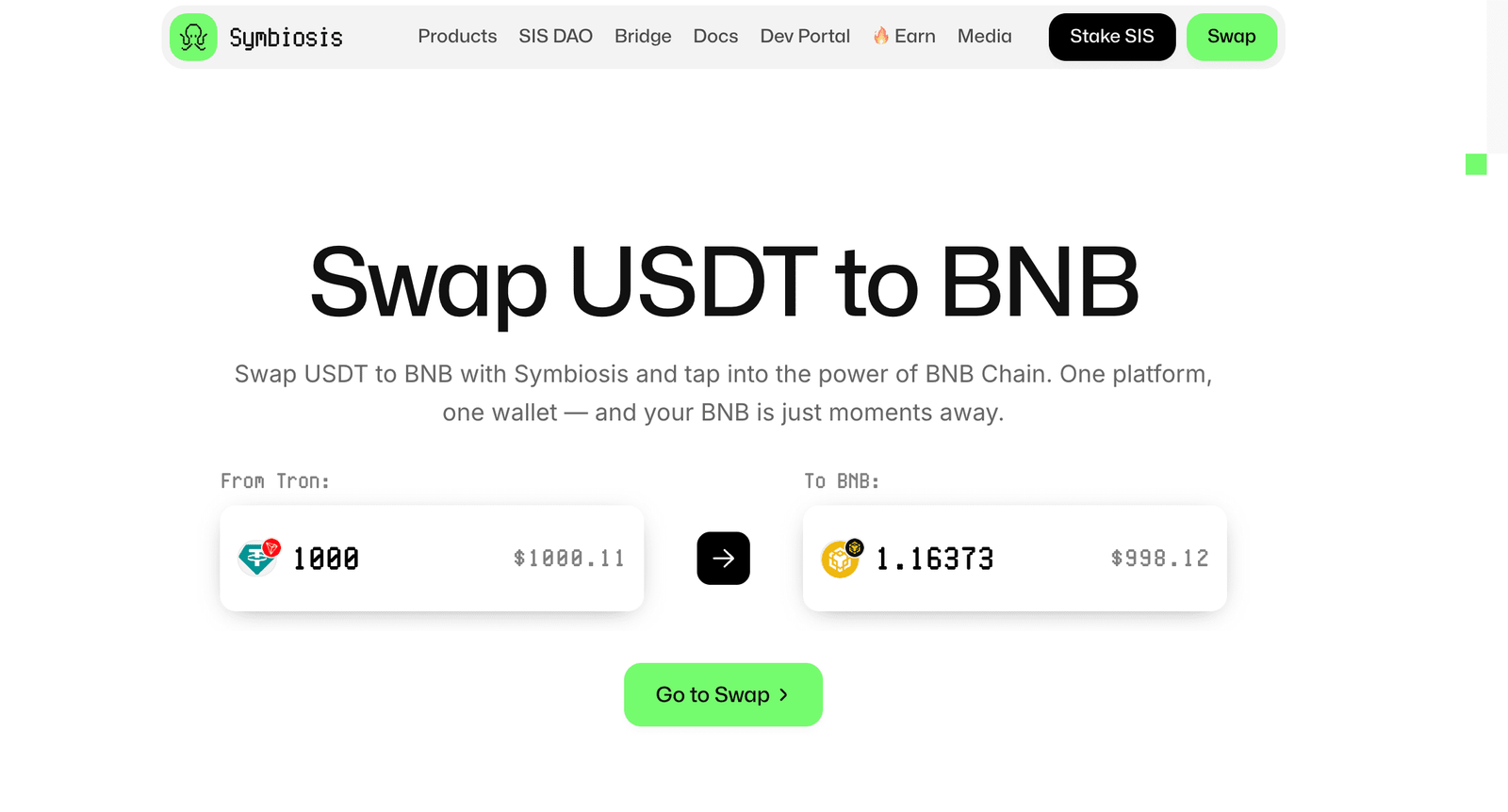

Now, let’s get to the meat of it. Selling crypto on MetaMask typically involves swapping your tokens for a stablecoin, then moving to an exchange for USD, or using a direct fiat off-ramp. I’ll break it down into clear steps, with options depending on your setup.

Step 1: Connect to MetaMask Portfolio or a DEX

MetaMask Portfolio is your starting point for a seamless experience. Open your MetaMask wallet, click the three dots in the top-right corner, and select “Portfolio.” This takes you to MetaMask’s official dashboard, where you can manage assets across chains. Alternatively, head to a decentralized exchange like Uniswap or SushiSwap directly through your browser.

In MetaMask Portfolio, hit the “Sell” button. It’s designed to guide you through providers that support fiat off-ramps, like MoonPay or Transak, depending on your region. For DEXs, connect your wallet by clicking “Connect Wallet” on Uniswap’s site and approving the link in MetaMask. Always verify the URL—fake sites mimic real ones to steal your keys.

Step 2: Choose Your Crypto and Amount

In MetaMask Portfolio, select the token you want to sell (say, ETH or DAI) and enter the amount. You’ll see real-time quotes from providers showing how much USD you’ll get after fees. On a DEX like Uniswap, pick your token pair—ETH to USDC, for example. Enter the amount, and Uniswap will calculate the output based on current market rates. Check the “slippage tolerance” (set it to 0.5%-1% for most trades) to avoid getting burned by price swings.

Here’s a pro tip: stablecoins like USDC or USDT are your best bet for selling. They hold a 1:1 peg to USD, so you lock in value without worrying about ETH’s volatility while you move to the next step.

Step 3: Review Fees and Confirm the Swap

Every transaction on Ethereum or Layer 2s comes with gas fees, paid in ETH. MetaMask will display the estimated cost before you confirm. If gas is sky-high (say, $50+), consider waiting for a quieter network period—early mornings or weekends often have lower fees. On Uniswap, you’ll also see a “protocol fee” (usually 0.3%). Compare this to MetaMask Portfolio’s provider fees, which might range from 1%-3% but include fiat conversion.

Once you’re happy, hit “Confirm” in MetaMask. Double-check the transaction details—wrong addresses or scam contracts are a one-way ticket to losing funds. After confirmation, the swap happens instantly, and your new tokens (like USDC) appear in your wallet.

Step 4: Move to a Centralized Exchange

If you swapped to a stablecoin, it’s time to get USD. Open an account on a U.S.-friendly exchange like Coinbase or Kraken if you don’t already have one. Copy your exchange’s deposit address for USDC or ETH, then head back to MetaMask. Click “Send,” paste the address, and enter the amount. Triple-check the address—blockchain transactions are permanent.

Approve the transfer in MetaMask, pay the gas fee, and wait for the funds to hit your exchange account (usually 5-30 minutes, depending on the network). On Coinbase, go to “Trade,” sell your USDC for USD, and withdraw to your linked bank account. Withdrawals typically take 1-3 business days, though some banks support instant transfers for a fee.

Step 5: Direct Fiat Off-Ramp (Optional)

If MetaMask Portfolio offers a direct sell option in your state, you can skip the exchange. After selecting “Sell,” choose a provider like MoonPay, complete KYC (name, ID, etc.), and link your bank account. Enter the amount, review the quote, and confirm. Funds land in your bank in 1-5 days, minus fees. This is simpler but might cost more—compare rates to ensure you’re not overpaying.

Layer 2 Solutions for Cheaper Transactions

Ethereum’s gas fees can sting, especially during market pumps. If your crypto’s on a Layer 2 like Optimism, Arbitrum, or Polygon, you’re in luck—fees are often under $1. MetaMask supports these networks natively. Switch to your preferred Layer 2 in the wallet’s network dropdown, then use a DEX like QuickSwap (Polygon) or Uniswap (Optimism) to swap tokens. Bridge your stablecoins back to Ethereum mainnet or directly to an exchange using a service like Hop Protocol if needed.

Layer 2s are a game-changer for Americans who want to save on fees without sacrificing speed. Just ensure your exchange accepts deposits from your chosen network—Coinbase, for instance, supports Polygon and Arbitrum deposits.

Security Moves to Lock In Your Gains

Crypto’s a battlefield, and selling exposes you to risks. Here’s how to stay bulletproof:

- Phishing Defense: Only use official sites. Bookmark MetaMask Portfolio and your exchange. Scammers love fake pop-ups or emails promising “urgent wallet updates.”

- Wallet Hygiene: Never share your seed phrase. Use a hardware wallet like Ledger for large amounts, and keep MetaMask on a clean device.

- Tax Prep: Selling crypto triggers capital gains tax in the U.S. Track your cost basis (what you paid for the crypto) and sale price. Tools like Koinly or CoinTracker integrate with MetaMask to simplify reporting.

- Small Test Transactions: Sending to an exchange? Start with $10 to confirm the address works before moving your whole stack.

One slip can cost you everything. I’ve seen too many horror stories—don’t add yours to the list.

Tax Implications for Americans

Selling crypto isn’t just about cash—it’s about Uncle Sam. In the U.S., crypto is treated as property, so every sale is a taxable event. If you bought ETH at $1,000 and sold at $3,000, that $2,000 gain is taxable. Short-term gains (held under a year) are taxed as ordinary income (up to 37%), while long-term gains (over a year) range from 0%-20%, depending on your bracket.

Keep records of every transaction—MetaMask’s history tab helps, but it’s not foolproof. If you’re swapping tokens (say, ETH to USDC), that’s a sale too, so log both sides. Exchanges like Coinbase provide tax forms (1099-MISC or 1099-B), but DEXs don’t, so you’re on the hook for tracking. If your gains are small, you might offset them with losses from other trades—talk to a CPA to maximize deductions.

Common Pitfalls and How to Dodge Them

The road to cashing out isn’t always smooth. Here are traps to sidestep:

- High Gas Fees: Don’t sell during a network frenzy—check gas prices on sites like Etherscan.io. Layer 2s or off-peak times save you cash.

- Scam Providers: Stick to vetted platforms. If a fiat off-ramp asks for your seed phrase, run.

- Market Timing: Crypto’s volatile. If you’re selling to lock in profits, set a price target and stick to it—don’t chase pumps or panic on dumps.

- KYC Delays: Verify your exchange account early. Waiting until you’re ready to sell can stall your withdrawal for days.

Patience and prep are your allies. Rushing leads to regrets.

FAQs About Selling Crypto on MetaMask

Can I sell crypto directly to USD in MetaMask?

Yes, through MetaMask Portfolio’s “Sell” feature, you can cash out to USD via providers like MoonPay or Transak, depending on your state. You’ll need to complete KYC and link a bank account.

What are the fees for selling on MetaMask?

Expect gas fees ($1-$20, depending on the network and time) for swaps or transfers, plus provider fees (1%-3%) for fiat off-ramps. DEXs like Uniswap charge around 0.3% per trade.

Is it safe to sell crypto on MetaMask?

Yes, if you stick to official platforms and secure your wallet. Use trusted sites, avoid phishing links, and never share your seed phrase.

How long does it take to get USD in my bank?

Direct off-ramps take 1-5 days. Swapping to a stablecoin and using an exchange can be faster—1-3 days for bank withdrawals, sometimes instant with premium accounts.

Do I need an exchange to sell crypto?

Not always. MetaMask Portfolio’s fiat off-ramps let you sell directly, but exchanges like Coinbase often have lower fees or faster payouts for stablecoin conversions.

What taxes do I owe when selling crypto?

Selling triggers capital gains tax—short-term (up to 37%) for assets held under a year, long-term (0%-20%) for over a year. Track all trades for IRS reporting.

Conclusion

Selling crypto on MetaMask isn’t just about cashing out—it’s about taking control. Whether you’re locking in a win, dodging a crash, or funding your next move, you’ve got the tools to make it happen fast and secure. The steps are simple: prep your wallet, swap smart, and move to USD with an exchange or direct off-ramp. Stay sharp on fees, taxes, and security, and you’ll come out ahead.

Crypto’s a wild ride, but it’s your ride. With MetaMask, you’re not waiting on some suit to approve your moves—you’re the one calling the shots. So go execute, lock in those gains, and keep building your financial future. The market doesn’t wait, and neither should you.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino