At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

Sell Crypto on Phantom: Step-by-Step Guide

Table of Contents

You’re holding Solana, Ethereum, or maybe some memecoins in your Phantom Wallet, and the market’s ripe for cashing out. Whether it’s locking in profits from a Bitcoin pump or unloading NFTs before a dip, selling crypto from a non-custodial wallet like Phantom puts you in the driver’s seat—no middleman, no trust required. But it’s not a one-tap job. You’ll need to navigate swaps, transfers, and exchanges while dodging scams and keeping the IRS off your back. This guide, crafted for American users, breaks down how to sell crypto on Phantom Wallet in clear, actionable steps. We’ll cover swapping tokens, moving funds to exchanges, and converting to USD, all while keeping your assets secure and your tax obligations square.

Why Use Phantom Wallet to Sell Crypto?

Phantom Wallet is a heavyweight in the Web3 world, trusted by over 3.2 million monthly active users for its slick interface and multichain support across Solana, Ethereum, Polygon, Bitcoin, Base, and Sui. Unlike custodial exchanges, Phantom is non-custodial, meaning you control your private keys—your crypto stays yours, not some platform’s. This is critical in a landscape where exchange hacks have drained billions. Phantom’s built-in features, like token swapping and NFT management, make it a one-stop shop for DeFi and digital collectibles, while its integration with hardware wallets like Ledger adds an extra layer of security.

For Americans, Phantom’s appeal lies in its flexibility. You can swap tokens directly in the wallet or transfer them to a U.S.-compliant exchange to cash out to USD. Plus, its transaction history is exportable, helping you stay on top of tax reporting—a must when every crypto sale is a taxable event in the U.S. But selling isn’t as simple as hitting “cash out.” Let’s dive into the playbook to get your crypto from Phantom to dollars in your bank account.

Step-by-Step Guide to Selling Crypto on Phantom Wallet

Selling crypto from Phantom involves either swapping tokens within the wallet or transferring them to a centralized exchange to convert to USD. Since Phantom doesn’t directly support fiat off-ramps (converting crypto to USD), you’ll typically move your assets to an exchange like Coinbase, Kraken, or Binance.US. Below is a detailed guide for American users, focusing on Solana (SOL) as an example, but the process applies to other supported tokens like ETH, USDC, or Bitcoin.

Step 1: Set Up and Secure Your Phantom Wallet

If you don’t have Phantom, download it from the official website (phantom.app). Choose the browser extension for Chrome, Firefox, Brave, or Edge, or grab the mobile app for iOS or Android. Open Phantom and select “Create New Wallet” or “Import Existing Wallet” if you have a 12-word secret recovery phrase. For new wallets, Phantom generates a recovery phrase—write it down on paper, store it offline in a safe place, and never share it. This phrase is your only way to recover your funds if you lose access.

Set a strong password and enable biometric authentication (Face ID or fingerprint) on mobile for extra security. Consider connecting a Ledger hardware wallet for offline key storage, especially if you’re holding significant assets. Once set up, ensure you have crypto in your wallet—check your balance on the main screen under “Wallet.” If your funds are elsewhere, deposit them by clicking “Receive,” selecting your token (e.g., SOL), and copying your wallet address to share with the sender.

Step 2: Swap Tokens Within Phantom (If Needed)

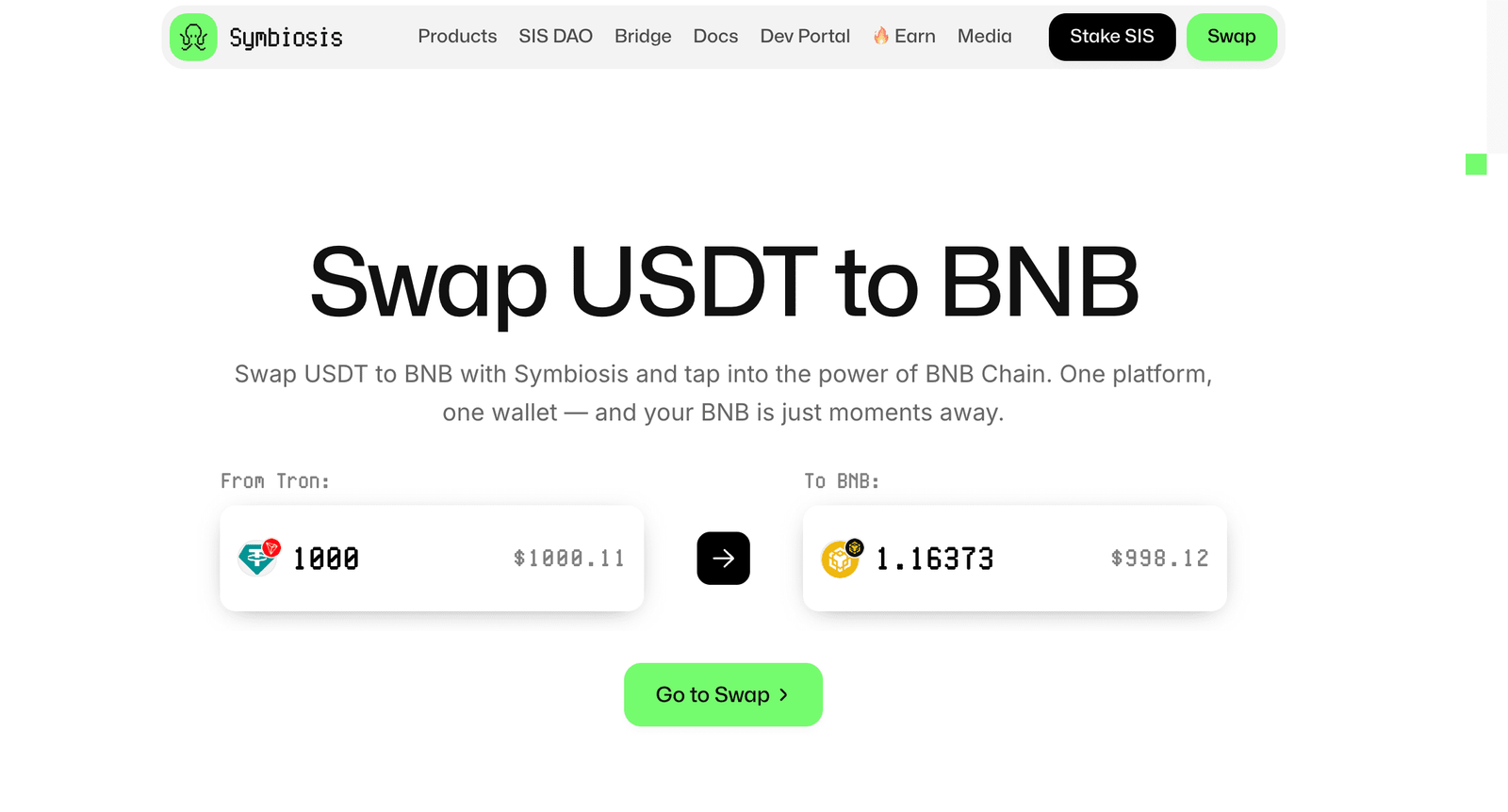

If you’re holding tokens that aren’t widely traded on exchanges (e.g., niche Solana memecoins), you may need to swap them for a liquid asset like SOL, ETH, or USDC first. Phantom’s built-in swap feature makes this easy. Open the wallet, click the “Swap” tab (the arrows icon), and select the token you want to sell (e.g., a memecoin) and the token you want to receive (e.g., SOL). Enter the amount, review the transaction details—including price, fees, and slippage (the price change tolerance)—and click “Swap.” Confirm the transaction via your password or biometric authentication.

Phantom uses decentralized exchanges (DEXs) like Jupiter or Raydium for swaps, aggregating the best prices across Solana’s ecosystem. Be mindful of network fees (gas) on Solana or Ethereum, which vary based on congestion. For example, Solana fees are typically under $0.01, while Ethereum gas can range from $1 to $50 during peak times. Double-check the swapped tokens appear in your wallet before proceeding.

Step 3: Choose a U.S.-Compliant Exchange

To convert your crypto to USD, you’ll need a centralized exchange (CEX) that supports fiat withdrawals. Top options for Americans include Coinbase, Kraken, and Binance.US, all registered with FinCEN and compliant with U.S. regulations. If you don’t have an account, sign up on your chosen exchange and complete KYC verification, which requires a government-issued ID and sometimes proof of address. For fiat withdrawals, link a bank account via ACH or wire transfer. Coinbase, for instance, processes ACH withdrawals for free or with a $10-$25 fee for wires, with funds arriving in 1-5 business days.

Ensure the exchange supports the crypto you’re selling (e.g., SOL, ETH, or USDC). Most major exchanges list these, but check CoinMarketCap’s Markets section for confirmation if you’re unsure. Set up two-factor authentication (2FA) using an app like Google Authenticator to secure your account.

Step 4: Transfer Crypto from Phantom to the Exchange

Log into your exchange account and navigate to the “Wallet” or “Deposit” section. Select the cryptocurrency you’re transferring (e.g., SOL) and choose the correct network (e.g., Solana blockchain, not Ethereum). Copy the deposit address provided by the exchange. In Phantom, click “Send,” select the token, paste the exchange’s deposit address, and enter the amount. Double-check the address—sending to the wrong one means permanent loss. Confirm the transaction with your password or biometric authentication.

Transfers typically take seconds on Solana or minutes on Ethereum, depending on network speed. Monitor the transaction in Phantom’s “Activity” tab and check your exchange wallet to confirm the funds arrived. If they don’t appear, ensure you selected the correct network and contact the exchange’s support.

Step 5: Sell Crypto on the Exchange

Once your crypto is in the exchange wallet, go to the “Trade” or “Sell” section. You have two options: a market order (sells instantly at the current price) or a limit order (sells at a specific price you set). For quick sales, choose a market order. Select the crypto (e.g., SOL), enter the amount, and choose USD as the output. Review the fees—Coinbase charges 0.5-4.5% depending on the transaction size, while Kraken’s fees start at 0.16%. Confirm the trade, and the USD will appear in your exchange’s fiat wallet.

If you’re selling NFTs, list them on a marketplace like Magic Eden via Phantom’s “NFT” tab, convert the proceeds to SOL or USDC, then transfer to the exchange as above. NFT sales may incur higher gas fees, especially on Ethereum.

Step 6: Withdraw USD to Your Bank Account

In the exchange, go to the “Withdraw” or “Cash Out” section and select USD. Choose your linked bank account and enter the amount. ACH withdrawals are often free and take 1-3 business days, while wire transfers cost $10-$25 but arrive same-day or next-day. Verify the bank details to avoid delays. Once the funds hit your account, you’ve successfully sold your crypto.

Keep records of the transaction, including the sale price, fees, and bank deposit confirmation, for tax purposes. Export your Phantom and exchange transaction histories for easy reporting.

Tax Implications for U.S. Users

Selling crypto in the U.S. is a taxable event, per IRS rules. The agency treats cryptocurrency as property, so you owe capital gains tax on profits. For example, if you bought 1 SOL for $100 and sold it for $150, you report a $50 gain. Short-term gains (assets held less than a year) are taxed as ordinary income (10-37% based on your bracket), while long-term gains (held over a year) face 0-20% rates. Swapping tokens in Phantom (e.g., memecoin to SOL) is also taxable, as it’s considered a sale.

Use software like CoinTracker or Koinly to calculate gains by importing Phantom and exchange data. Report sales on IRS Form 8949 and Schedule D. If you earn over $600 in crypto transactions, exchanges like Coinbase may issue a 1099-MISC. Consult a tax professional if your portfolio’s complex, as audits are increasing. For details, check the IRS’s crypto guidance at irs.gov.

Tips for a Secure and Efficient Sale

- Verify Addresses: Triple-check deposit addresses before sending crypto. A single typo can wipe out your funds.

- Watch Fees: Compare exchange fees and network gas costs. Solana’s low fees make it ideal for small transactions, but Ethereum can sting.

- Secure Your Recovery Phrase: Store your 12-word phrase in a fireproof safe or split it across multiple locations. Never save it digitally.

- Use 2FA and Biometrics: Enable 2FA on exchanges and biometric locks in Phantom to thwart hackers.

- Time the Market: Don’t sell in a panic. Set price targets or use limit orders to maximize profits.

Common Pitfalls and How to Avoid Them

The crypto world’s a minefield, but you can sidestep the traps:

- Phishing Scams: Only download Phantom from phantom.app. Ignore DMs claiming to be Phantom Support—they’re after your recovery phrase.

- Wrong Networks: Sending SOL to an Ethereum address or vice versa is a one-way ticket to loss. Match the blockchain.

- KYC Delays: Complete exchange verification early to avoid hold-ups when you’re ready to cash out.

- Tax Oversights: Track every swap and sale. Missing a taxable event can trigger IRS penalties.

- High Gas Fees: Check Ethereum gas prices before swapping or transferring. Use Solana for cheaper transactions when possible.

FAQs

Can I sell crypto directly from Phantom Wallet to USD?

No, Phantom doesn’t support direct fiat withdrawals. You must transfer crypto to an exchange like Coinbase or Kraken to sell for USD.

How long does it take to get USD after selling?

After selling on an exchange, ACH withdrawals take 1-3 business days, while wire transfers can arrive same-day or next-day, depending on the exchange.

Are there fees for selling crypto from Phantom?

Phantom’s swap feature incurs network fees (e.g., $0.01 for Solana, $1-$50 for Ethereum). Exchanges charge trading fees (0.1-4.5%) and withdrawal fees ($0-$25).

Is Phantom safe for selling crypto?

Yes, Phantom’s non-custodial design keeps your keys secure. Use 2FA, biometrics, and a hardware wallet for maximum safety, and never share your recovery phrase.

Do I need to report Phantom swaps to the IRS?

Yes, swapping tokens (e.g., memecoin to SOL) is a taxable event. Report gains or losses on Form 8949, even if you don’t cash out to USD.

Conclusion

Selling crypto on Phantom Wallet is your ticket to staying in control—no handing your keys to a shady exchange, no praying a platform doesn’t implode. With a few sharp moves, you can swap tokens, transfer to a trusted exchange, and land USD in your bank account, all while keeping your assets locked down. The process demands precision—verify addresses, time your sales, and track every transaction for the IRS. But once you’ve got the playbook, it’s straightforward. Secure your recovery phrase, dodge the scams, and execute with confidence. The market’s wild, but you’re armed to dominate it. Take the reins and make your next move count.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem

Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino