At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

How to Sell Crypto on Uphold in Minutes

Table of Contents

The crypto market’s a beast—Bitcoin’s surging, Ethereum’s climbing, and you’re sitting on coins ready to cash out. Whether you’re locking in profits or dodging a dip, Uphold makes selling crypto fast, secure, and painless for American users. With support for over 250 cryptocurrencies, low fees, and a platform that’s regulated by FinCEN, Uphold’s built to get your USD in hand without the headaches of sketchy exchanges or endless delays. But speed doesn’t mean reckless. The IRS is watching, and every sale’s a taxable event. This guide cuts through the clutter, delivering a step-by-step playbook to sell crypto on Uphold in minutes, keep your funds safe, and stay compliant with U.S. tax rules. Let’s dive in and turn your digital assets into dollars.

Why Choose Uphold for Selling Crypto?

Uphold stands out in the crowded crypto space for its simplicity and versatility. Unlike some exchanges that limit you to a handful of coins, Uphold supports trading in Bitcoin, Ethereum, XRP, stablecoins like USDC, and even precious metals or fiat currencies. Its “Anything-to-Anything” trading model lets you sell crypto for USD, another coin, or even gold in a single step, with transparent pricing and no hidden spreads. For U.S. users, Uphold’s compliance with FinCEN regulations ensures your transactions are above board, and its user-friendly interface—available on web and mobile—makes selling accessible whether you’re a newbie or a seasoned trader.

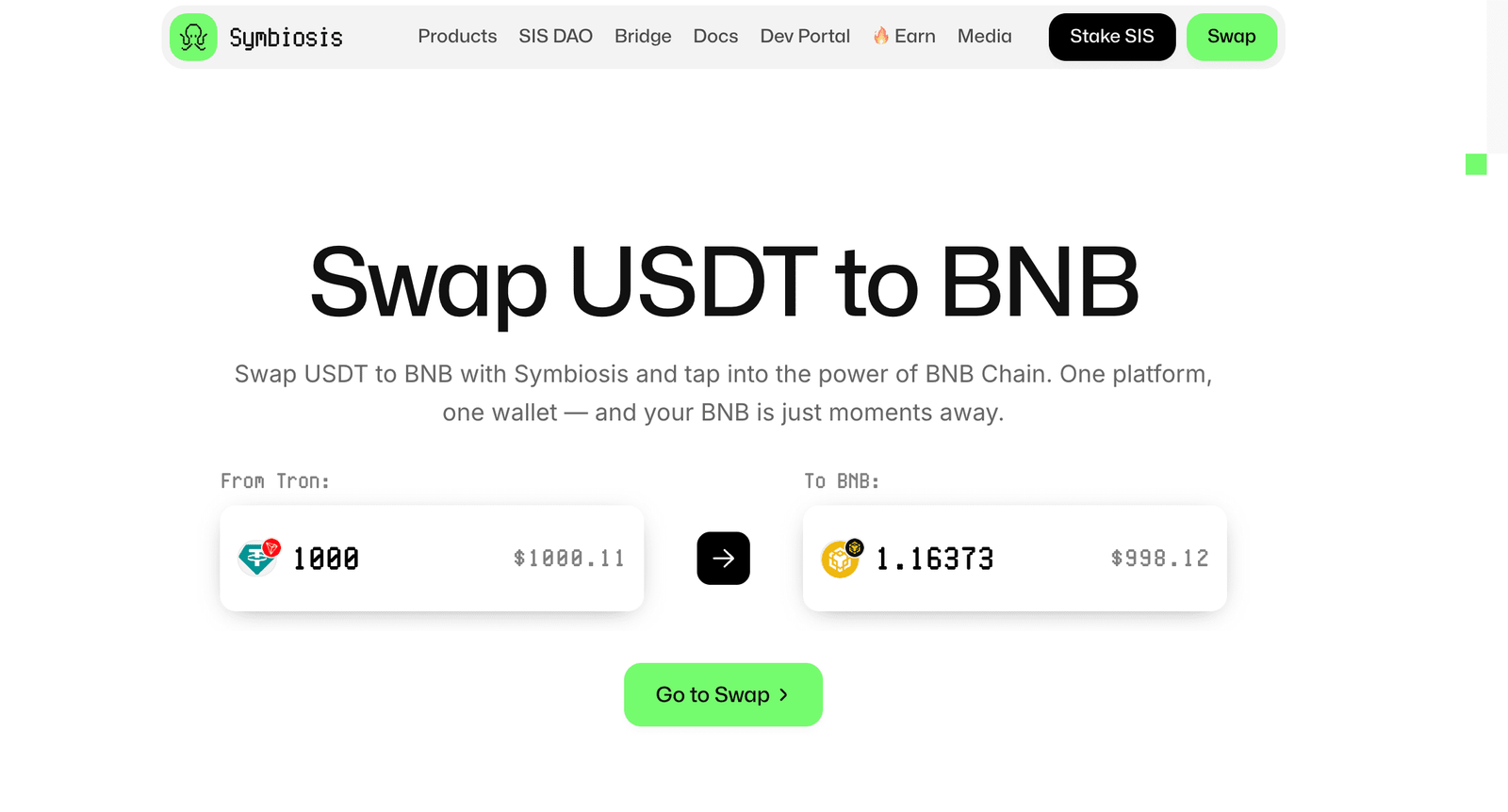

Fees are another win. Uphold charges no trading fees for crypto-to-fiat sales, though you’ll face network fees for withdrawals (e.g., $0.99 for some tokens like TRX) and a spread baked into the price. Compared to exchanges like Coinbase, which can hit you with 1-2% trading fees, Uphold’s cost structure is lean. Plus, its integration with tax tools like CoinLedger or Koinly simplifies reporting for the IRS, a must when every sale triggers capital gains or losses. Whether you’re cashing out $100 or $10,000, Uphold’s designed to keep you in control.

Step-by-Step Guide to Selling Crypto on Uphold

Selling crypto on Uphold is as close to a one-tap process as it gets, but you’ll need to set things up right to avoid snags. This guide walks you through selling Bitcoin for USD using Uphold’s Transact panel, the fastest method for most users. If you’re selling other cryptocurrencies like Ethereum or XRP, the process is nearly identical. We’ll also cover withdrawing your USD to a bank account and handling tax implications for U.S. users.

Step 1: Set Up and Verify Your Uphold Account

If you’re new to Uphold, start by creating an account at the official website (uphold.com). Click “Sign Up,” enter your email, and set a strong password. Enable two-factor authentication (2FA) via an app like Google Authenticator to lock down your account—crypto platforms are prime targets for hackers. For U.S. users, Uphold requires Know Your Customer (KYC) verification to comply with anti-money-laundering laws. Submit a government-issued ID (driver’s license or passport), a selfie, and basic financial details like your employment status. Verification usually takes minutes but can stretch to a day during peak times.

Once verified, link a bank account for USD withdrawals. Go to the “Add Card/Bank” section, select “Bank Account,” and input your ACH or wire transfer details. Ensure the account is in your name, as Uphold rejects third-party transfers. You’ll also need to provide your Social Security Number (SSN) for tax reporting, as Uphold is legally obligated to share transaction data with the IRS.

Step 2: Deposit Crypto to Your Uphold Wallet

To sell, you need crypto in your Uphold wallet. If your coins are already on Uphold, skip to Step 3. If they’re in another wallet (e.g., MetaMask) or exchange (e.g., Coinbase), transfer them to Uphold. From your Uphold dashboard, open the Transact panel and select the cryptocurrency you want to deposit (e.g., Bitcoin). Choose the correct blockchain network (e.g., Bitcoin Network for BTC) and copy the deposit address. Paste this address into the sending wallet or exchange, double-check it to avoid losing funds, and confirm the transfer. Deposits typically take minutes to hours, depending on the blockchain’s speed—Bitcoin can take 10-30 minutes, while XRP is near-instant.

If you don’t own crypto yet, you can buy directly on Uphold using a linked bank account or debit card. However, this guide assumes you’re selling existing holdings.

Step 3: Navigate to the Transact Panel

Log in to Uphold on the web or mobile app. From the dashboard, click or tap the “Transact” button (on mobile, it’s under the “Activity” tab). This opens the trading interface, where you can sell crypto for USD or another asset. Select your funding source in the “From” field—choose the cryptocurrency you want to sell, like Bitcoin. In the “To” field, select “USD” to sell for fiat. If you prefer to trade for another crypto (e.g., USDC), you can select that instead, but we’ll focus on USD for simplicity.

Step 4: Enter the Sale Amount

In the Transact panel, input the amount of crypto you want to sell. You can enter the quantity (e.g., 0.01 BTC) or the USD equivalent (e.g., $500). Uphold’s clever equivalent field calculates the conversion in real-time based on the current market price, including the spread. For example, if 0.01 BTC equals $500 USD, you’ll see both values displayed. Review the transaction details, including any network fees (usually minimal for in-platform sales), and ensure the USD amount aligns with your goals. If the market’s volatile, act fast—prices can shift in seconds.

Step 5: Confirm the Sale

Double-check the “From” and “To” fields, then click “Preview Transaction.” Uphold will show a final breakdown, including the spread (typically 0.8-1.5% for major coins like Bitcoin). If everything looks good, hit “Confirm.” The sale processes instantly, and your USD balance will update in your Uphold wallet. Unlike some exchanges that hold funds in limbo, Uphold’s transactions are near-instant, letting you move to withdrawal without delay.

Step 6: Withdraw USD to Your Bank Account

To get your USD out of Uphold, go to the Transact panel again. Select “USD” as the “From” source and your linked bank account as the “To” destination. Enter the amount to withdraw, keeping in mind Uphold’s withdrawal fees (e.g., $2.99 for ACH transfers). Confirm the transaction, and funds typically hit your bank in 1-3 business days for ACH or same-day for wire transfers. If you’re not ready to withdraw, you can hold USD in your Uphold wallet, where balances over $1,000 earn 4.9% APY.

Alternative Selling Methods on Uphold

The Transact panel is the fastest way to sell, but Uphold offers other options for advanced users. The Limit Order feature lets you set a target price for your crypto, executing the sale only when the market hits your price. This is ideal for traders aiming to maximize profits during volatile swings. Go to the “Trade” section, select “Limit Order,” choose your crypto and USD pair, and set your price and amount. Monitor the order in the “Activity” tab—it’ll execute automatically if the market cooperates.

You can also use Uphold’s debit card to spend your crypto directly, converting it to USD at the point of sale. This counts as a taxable sale, so track these transactions for tax purposes. For most users, though, the Transact panel’s simplicity and speed are hard to beat.

Tax Implications for U.S. Users

The IRS treats cryptocurrency as property, meaning every sale on Uphold is a taxable event. If you sell 0.01 BTC for $500 that you bought for $300, you owe capital gains tax on the $200 profit. Gains are short-term (taxed at your ordinary income rate, 10-37%) if you held the crypto for a year or less, or long-term (0-20%) if held longer. Uphold issues Form 1099-B for users who trade or dispose of crypto, and Form 1099-MISC for those earning over $600 in staking or airdrop rewards. These forms are sent to both you and the IRS, so accurate reporting is critical (irs.gov).

To calculate your gains, track your cost basis (purchase price) and sale price. Uphold’s transaction history, accessible via the “Activity” tab, lets you export a CSV file for tax software like CoinLedger or Koinly. Report your gains on IRS Form 8949 and Schedule D. If you’re dealing with complex transactions (e.g., crypto-to-crypto trades), consult a tax professional to avoid errors. Starting in 2025, Uphold will also issue Form 1099-DA for certain digital asset sales, further tightening IRS oversight.

Tips for a Smooth Selling Process

- Verify Early: Complete KYC and bank linking before you need to sell to avoid delays.

- Check Fees: Uphold’s spreads and withdrawal fees (e.g., $2.99 ACH) can add up. Compare with other platforms for large sales.

- Secure Your Account: Use 2FA and never share your login details. Uphold’s transparency reports show no asset lending, but hacks are always a risk.

- Track Market Trends: Sell during pumps to maximize USD, but set limit orders if you’re not glued to the charts.

- Export Transactions: Download your Uphold transaction history monthly for tax prep. It’s easier than scrambling in April.

Common Pitfalls and How to Avoid Them

The crypto game’s full of traps, but you can sidestep them with the right moves:

- Wrong Network Deposits: Sending Bitcoin to an Ethereum address means lost funds. Always match the blockchain network.

- Market Volatility: Prices can crash mid-transaction. Use limit orders or sell in small batches to hedge.

- Tax Oversights: Forgetting to report a $50 sale can trigger an IRS audit. Log every transaction, no matter how small.

- Withdrawal Delays: ACH transfers can take 3 days. Plan ahead if you need cash fast.

- Phishing Scams: Fake Uphold emails or DMs are common. Only log in via the official site or app.

FAQs

Can I sell any cryptocurrency on Uphold?

Yes, Uphold supports over 250 cryptocurrencies, including Bitcoin, Ethereum, XRP, and stablecoins like USDC. Check the Transact panel for available assets.

How long does it take to withdraw USD from Uphold?

ACH withdrawals take 1-3 business days, while wire transfers can arrive same-day. Delays may occur during high network congestion or bank holidays.

Are there fees for selling crypto on Uphold?

Uphold charges no trading fees for crypto-to-USD sales, but you’ll pay a spread (0.8-1.5%) and network fees for withdrawals (e.g., $0.99 for some tokens).

Is selling crypto on Uphold safe?

Yes, Uphold is regulated by FinCEN and uses 2FA and encryption. Never share your login or 2FA codes, and verify all URLs to avoid phishing scams.

Do I need to report Uphold sales to the IRS?

Yes, every crypto sale is a taxable event. Uphold issues 1099-B and 1099-MISC forms for qualifying transactions. Report gains on Form 8949 and Schedule D.

Conclusion

Selling crypto on Uphold is your ticket to turning digital gains into real-world dollars—fast, secure, and with minimal fuss. Its intuitive platform, broad asset support, and low fees make it a go-to for American users looking to cash out without the chaos of unregulated exchanges. But don’t sleep on the details: secure your account, track every sale for taxes, and move your USD to the bank before hackers sniff around. The market’s a wild ride, and the IRS doesn’t play, so arm yourself with this guide, execute your plan, and take charge of your financial future. Your next win’s just a few clicks away.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem

Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino