At NFT Droppers, we provide the latest crypto news, in-depth project information, and comprehensive market insights. Launched in 2022, our platform covers new token launches, market trends, and detailed reviews of crypto and NFT projects. We offer reliable ratings based on 70+ evaluation factors, including tokenomics, roadmaps, and team authenticity. Whether you’re an investor or a crypto enthusiast, NFT Droppers keeps you informed with accurate, up-to-date information and expert analysis.

What is Ethereum Classic and Is it good to investment in 2025?

Table of Contents

Crypto’s a wild ride, and Ethereum Classic (ETC) is one of its grizzled veterans. Born from a fiery split with Ethereum in 2016, it’s a blockchain that sticks to its guns—immutability, decentralization, and the original vision of smart contracts. I’ve spent years slicing through the noise of markets and code, from dodging rug pulls to catching pumps, and ETC’s story is a masterclass in grit. With its price hovering around $15 today and a market cap of $2.27 billion, the big question is: does ETC have the juice to be a solid bet in 2025? This guide breaks down what Ethereum Classic is, how it works, and whether it’s worth your hard-earned USD. No hype—just the raw deal.

What Is Ethereum Classic (ETC)?

Ethereum Classic is a decentralized blockchain platform that runs smart contracts—self-executing agreements coded to run without middlemen. It’s the original Ethereum blockchain, untouched by a controversial 2016 hard fork that birthed Ethereum (ETH). The split came after a hack drained $50 million from The DAO, a crowdfunded project on Ethereum. Most of the community, led by Vitalik Buterin, voted to rewrite the blockchain’s history to recover the funds, creating ETH. A stubborn minority refused, arguing that “code is law” and tampering breaks trust. They kept the unaltered chain alive as Ethereum Classic.

ETC uses Proof-of-Work (PoW), like Bitcoin, where miners solve puzzles to validate transactions and earn rewards. Its native token, ETC, pays for transaction fees and fuels smart contracts. With a capped supply of 210.7 million coins, ETC’s deflationary—unlike ETH’s uncapped model. It supports decentralized apps (dApps) and has carved a niche for purists who value immutability over flashy upgrades. Think of it as the blockchain that never bends, even when the world screams for compromise. Ethereum Classic Official Site

How Does Ethereum Classic Work?

ETC’s engine is its blockchain—a public ledger recording every transaction since 2015. Miners keep it secure, competing to add blocks and earn ETC. Unlike ETH’s shift to Proof-of-Stake (PoS), ETC sticks with PoW, which some argue is more decentralized since anyone with hardware can mine, not just big stakers. Transactions cost gas—fees paid in ETC—keeping the network humming.

Smart contracts are ETC’s killer feature. These coded agreements let developers build dApps for finance, gaming, or supply chains without trusting a bank or boss. Want to lend $1,000 peer-to-peer? A smart contract locks it until terms are met. ETC’s immutability means no one can rewrite the rules mid-game—a double-edged sword, as The DAO hack proved. The network’s lean—processing 15 transactions per second versus ETH’s 30—but it’s stable, with no major hacks since 2016.

You can hold ETC in wallets like MetaMask or Ledger, trade it on Binance or Coinbase, or mine it with a GPU rig. It’s versatile, but don’t expect ETH’s bells and whistles like Layer 2 scaling. ETC’s old-school, and it wears that badge with pride.

Why Does Ethereum Classic Matter?

ETC’s not chasing clout—it’s about principle. In a world where blockchains tweak rules for convenience, ETC’s immutability is a steel spine. It’s a haven for those who believe tampering with history, even to fix a hack, sets a dangerous precedent. That ethos resonates in DeFi, where trustless systems are king. ETC’s also a hedge against ETH’s PoS shift; miners who lost out on ETH flocked to ETC, boosting its hash rate 10x in 2022.

Its market cap ranks it #30 globally, with $875 million in daily volume. Not a giant like ETH’s $400 billion, but no slouch. Partnerships with firms like Chainlink for oracles show it’s still in the game. Yet, ETC’s rigid stance limits upgrades—ETH’s ecosystem dwarfs it with 700+ dApps versus ETC’s dozens. Still, for purists or miners, ETC’s a rare breed in a crypto sea of sellouts.

ETC Price History: A Rocky Road

ETC’s price is a saga of booms and busts. Born at $0.50 in 2016, it spiked to $46 in 2017’s bull run, only to crash to $3 by 2018. It clawed back to $12 in 2020, then soared to $167 in 2021’s mania—$1,000 became $33,400 at the peak. By 2022, it sank to $13. Today, it trades at $15.01, down 55% from last year but up 47% from January’s $10.21. Volatility’s the name of the game—24-hour swings hit 12%. CoinMarketCap ETC Data

What drives it? Bitcoin’s mood swings, for one—when BTC dipped to $93,000 recently, ETC felt the chill. ETH’s upgrades also cast a shadow; ETC rises when ETH stumbles. Listings on exchanges like Upbit or news of dApp growth spark pumps, but FUD—like network attacks in 2020—tanks it. With 150.5 million ETC circulating, scarcity could kick in as mining slows.

Is Ethereum Classic a Good Investment in 2025?

Let’s cut to the chase: ETC’s a gamble, but it’s got legs. Its low price—$15—means you can stack thousands of coins for $1,000, betting on a breakout. If it hits $50, that’s $3,333—a 233% return. But crypto’s brutal, and ETC’s no golden ticket. Here’s the breakdown to see if it fits your 2025 portfolio, with all costs in USD.

The Bull Case for ETC

ETC’s got unique strengths. Its capped supply—210.7 million coins—makes it scarcer than ETH, a hedge against inflation. PoW keeps it miner-friendly, and with ETH now PoS, ETC’s the last big PoW smart-contract chain besides Bitcoin. If miners rally, hash rate climbs, securing the network and boosting trust. DeFi’s another shot—ETC’s dApps, though few, grew 20% last year. A viral project like Pepe on ETH could ignite ETC.

Market signals look up. The Fear & Greed Index sits at 47—neutral, not panicked. ETC’s 40% green days last month show steady buying. If Bitcoin breaks $100,000 in 2025, altcoins like ETC often ride the wave. Analysts like CoinPedia forecast $55 by year-end, a 266% jump. A $1,000 investment at $15 buys 66.67 ETC; at $55, that’s $3,667. Long-term, some see $100 by 2030—your $1,000 becomes $6,667.

Adoption’s key. Chainlink’s integration and Grayscale’s ETC Trust signal institutional interest. If Trump’s crypto-friendly policies kick in, altcoins could soar. ETC’s low fees—$0.01 per transaction—beat ETH’s $5-$50 gas, luring small-scale dApps. A niche win, like supply chain pilots, could spark a rally.

The Bear Case for ETC

Now, the cold water. ETC’s trailing ETH—badly. Ethereum’s 700 dApps and $30 billion DeFi market dwarf ETC’s $100 million ecosystem. Developers flock to ETH’s upgrades; ETC’s tech feels dated, with no Layer 2 scaling. Its 15 TPS chokes under heavy loads, and past 51% attacks—three in 2020—scar its rep. If a big hack hits, trust could crumble.

Price risks are real. CoinCodex calls 2025 bearish, with a $26 floor if momentum fades. That $1,000 stack at $15 drops to $1,733—a 73% gain, but no moonshot. If ETC falls to $10, you’re at $667, a 33% loss. Volatility’s brutal—12% daily swings wipe out weak hands. Regulation’s another knife; a U.S. crackdown on PoW for energy use could gut ETC’s mining base.

Competition’s fierce. Cardano, Solana, and Polygon offer faster, cheaper dApps. If ETH solves scaling, ETC’s niche shrinks. Community chatter on X shows fading hype—posts lament low activity versus ETH’s buzz. Without a killer app or whale backing, ETC risks bleeding relevance.

Balancing the Scales

ETC’s a high-risk, high-reward play. Its fundamentals—immutability, PoW, low fees—give it an edge for purists and miners. A $1,000 bet could 3x in a bull run, but you could lose half in a crash. Compare it to ETH ($2,500) or ADA ($0.50)—ETC’s cheaper but less dynamic. If you’re diversifying, allocate 5-10% to ETC, not your whole stack. Never bet rent money—crypto’s a beast.

How to Invest in Ethereum Classic

Ready to roll? Here’s your playbook to buy, store, and trade ETC safely, with costs in USD.

- Choose an Exchange: Binance, Coinbase, or Kraken list ETC. Binance’s fees are tight—0.1% per trade ($1 on $1,000). Coinbase’s user-friendly but pricier—1.49% ($14.90). Sign up, verify ID, and deposit USD.

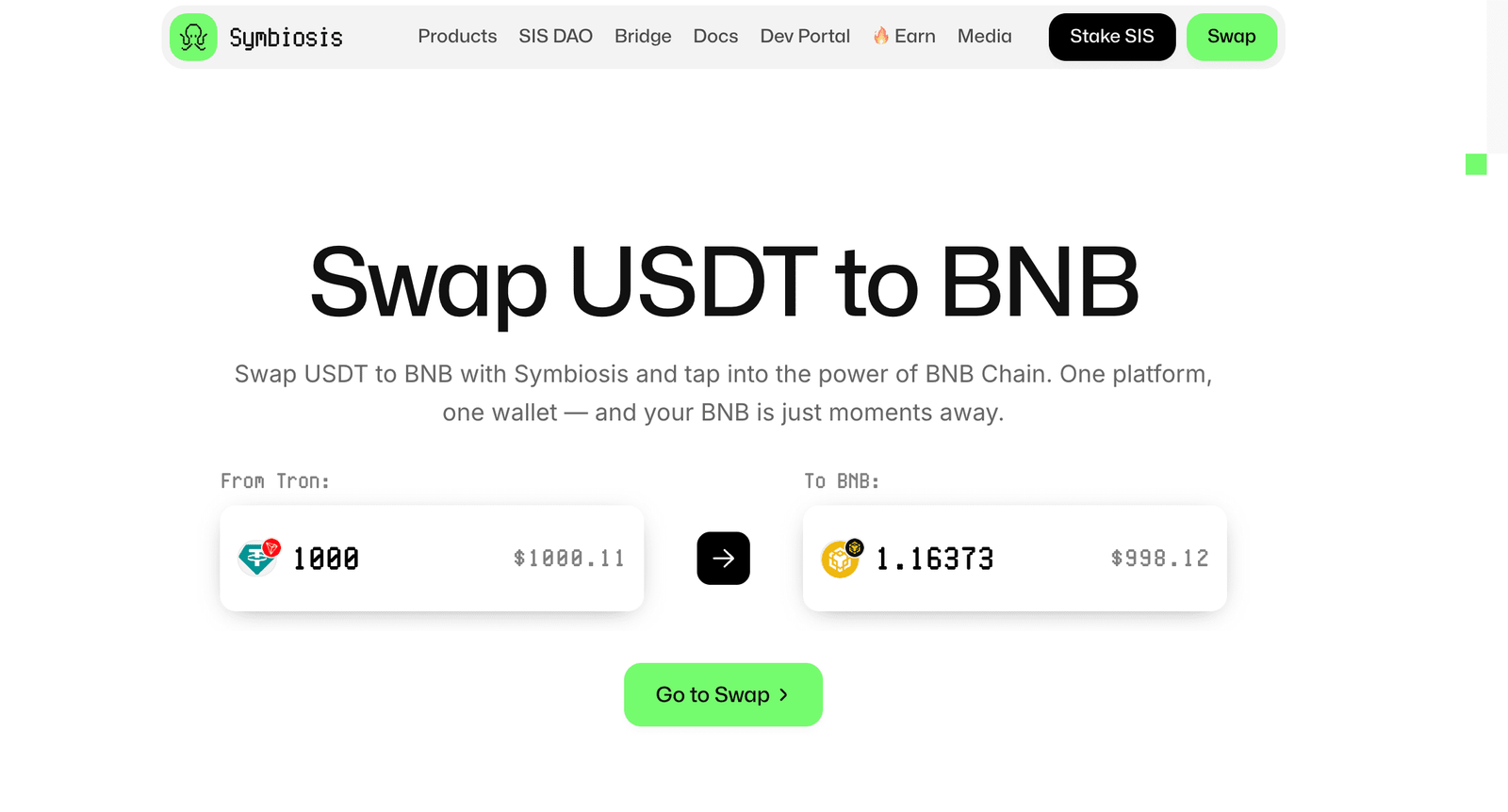

- Buy ETC: Search ETC/USDT, set a market order for speed or limit order to snipe a dip. Start with $50-$500 to test. Fees range $0.10-$15, depending on the platform.

- Store Securely: Move ETC to a wallet—MetaMask’s free, Ledger’s $70 for top safety. Write down your seed phrase; lose it, lose your coins. Exchanges get hacked—don’t leave funds there.

- Trade Smart: Watch ETC’s 50-day moving average ($16). Above it, bulls rule; below, bears bite. Set stop-losses at 10% below entry to cap losses—$90 on $1,000.

- Stay Scam-Free: Fake apps and phishing links prey on newbies. Download only from official sites. If a deal screams “too good,” it’s a trap.

Pro move: dollar-cost average—buy $100 monthly to smooth out swings. Check X for sentiment, but don’t chase FOMO.

Alternatives to Ethereum Classic

ETC’s not your only shot. Here’s how it stacks up:

- Ethereum (ETH): $2,500, 30 TPS, 700 dApps. More dynamic but pricier fees. Safer bet for DeFi. $1,000 buys 0.4 ETH.

- Cardano (ADA): $0.50, 250 TPS, eco-friendly PoS. Scalable but less mature. $1,000 buys 2,000 ADA.

- Solana (SOL): $150, 65,000 TPS, NFT-heavy. Fast but centralization risks. $1,000 buys 6.67 SOL.

ETC’s edge is its low entry and PoW purity. If you want speed, SOL’s better; for stability, ETH’s king. Spread your bets—crypto’s no one-trick pony.

FAQs About Ethereum Classic (ETC)

What’s the difference between ETH and ETC?

ETH forked from ETC in 2016 to reverse a hack; ETC kept the original chain. ETH uses PoS, ETC sticks with PoW. ETH’s ecosystem is bigger, but ETC’s immutable.

Can ETC hit $100 in 2025?

Possible but tough—needs a 566% jump from $15. Analysts see $55 max. By 2030, $100’s more feasible if adoption spikes.

Is ETC safe to buy?

As safe as any crypto—volatile but legit. Use trusted exchanges like Coinbase and secure wallets. Past attacks hurt ETC, but no major hacks since 2020.

How do I mine ETC?

Get a GPU rig ($500-$2,000), join a pool like Ethermine, and download mining software. Earn $1-$5 daily per rig, depending on power costs ($0.10-$0.30/kWh).

Why’s ETC so cheap?

Smaller ecosystem than ETH, less developer buzz, and past security scares keep it low. At $15, it’s a bargain if you believe in its principles.

Conclusion

Ethereum Classic is crypto’s stubborn rebel, holding fast to immutability in a world of compromise. At $15, it’s a cheap ticket to a blockchain with real chops—PoW, smart contracts, and a capped supply. For 2025, it’s a high-stakes bet: $1,000 could triple to $3,667 if it hits $55, but a dip to $10 leaves you at $667. Its strengths—low fees, miner loyalty—face headwinds from ETH’s dominance and slow upgrades. Buy smart, store safe, and never bet more than you can burn. Check X for the latest buzz, diversify your bag, and play the long game. ETC’s no moonshot, but it’s a fighter—time to decide if you’re in the ring.

Disclaimer: The information presented here may express the authors personal views and is based on prevailing market conditions. Please perform your own due diligence before investing in cryptocurrencies. Neither the author nor the publication holds responsibility for any financial losses sustained.

Top Crypto Presales

Ionix Chain $IONX

Ionix Chain $IONXBEST CRYPTO CASINO

TOP EXCHANGES

CRYPTO PAYMENT GATEWAY

Crypto Cloud

Crypto CloudBEST HARDWARE WALLET

Tangem

Tangem Stake.com

Stake.com Coins.Game Casino

Coins.Game Casino